There are currently many financial startups operating in Indonesia, and the number is increasing over time.

These startups are innovative companies that are either in development or have recently started operations. They are part of the growing financial technology industry.

See Tutorial Account Verification Jack

Financial technology companies are businesses that have innovated in the financial sector and have been able to leverage modern technology. They are a great choice for providing funding to small and medium enterprises (SMEs) and individuals.

So far, the presence of financial technology companies has led to continued growth and rapid development of startup companies in Indonesia.

See Also: Corporate Credit Card: Definition, Types, Benefits, and How Cards Work for Startups

Financial Startups in Indonesia

Technology is advancing rapidly without limits, which requires every individual to work hard and continue to innovate to create something of higher quality that can be easily used.

Here are some financial startups in Indonesia that are currently gaining popularity:

1. JULO Digital Credit

JULO is a financial technology startup in Indonesia that has successfully achieved its goals since its establishment in 2016. The company is now able to serve customers in all provinces of Indonesia and is committed to providing financial inclusion to all Indonesian citizens to achieve financial well-being.

The company has also obtained a business license to provide services in accordance with the decision of the OJK and is even recommended as the main choice for anyone looking for a trusted credit application service.

The benefits of using this digital credit application can be accessed in all 37 provinces of Indonesia to obtain easy credit limits according to predetermined requirements.

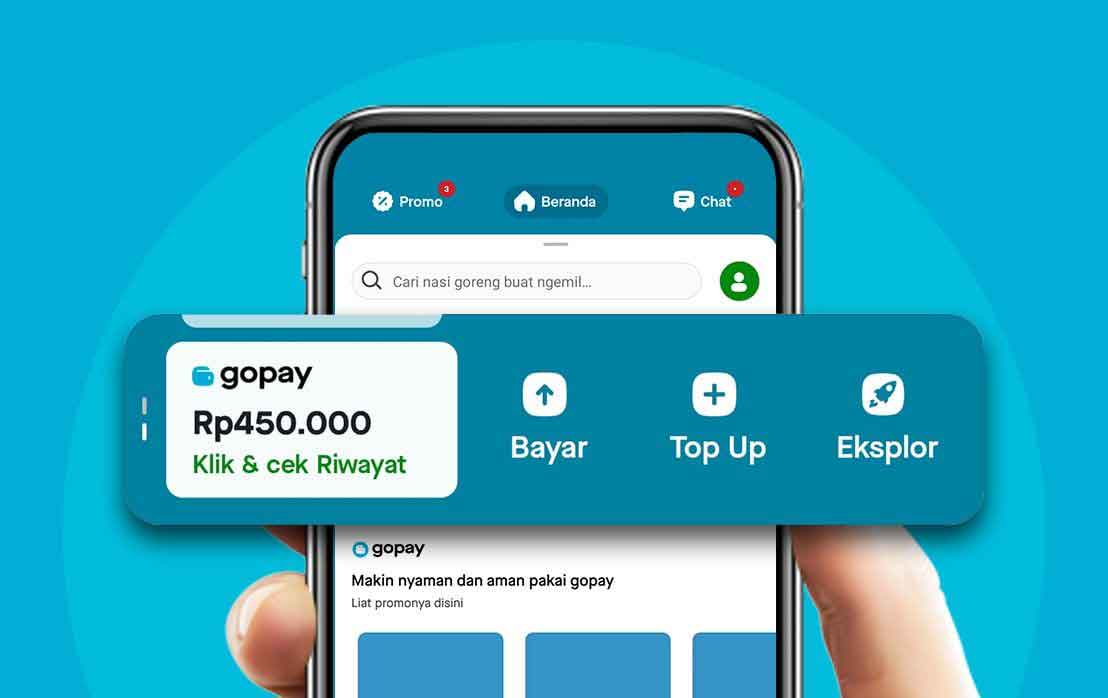

2. GoPay

GoPay is a digital payment service offered by Gojek to provide convenience in performing transactions needed by users. This Indonesian startup specializes in ride-hailing, digital payments, and logistics.

Since October 2017, transactions made through this digital wallet have contributed up to 30% of all transactions using e-money available in Indonesia.

This demonstrates that the financial startup movement in Indonesia is experiencing rapid growth and is widely used by the public.

3. Investree

Investree is also one of the startups in Indonesia in the financial technology sector that has been widely used by all members of society.

This particular startup has a very simple mission to make it an online marketplace that brings together people who need funding.

With the presence of this startup, not only can funds be collected, but loans can also be made much more easily accessible and accessible to borrowers.

So anyone who needs funding quickly doesn’t have to worry anymore because there is an Indonesian startup in the financial technology sector that can be used as a reference for choice.

4. Doku

Doku is one of the financial startups in Indonesia that has a digital wallet feature and is equipped with the use of credit cards and cash wallets.

In this case, users can use it to carry out transactions with several merchants that have joined the application.

In addition, this startup also offers various merchant options for conducting transactions, from fashion, retail, tour and travel, and others.

Most merchants in this startup company will provide the convenience of using a cashless system.

5. Tanifund

The innovation presented in Indonesian startups in the financial technology sector is not only limited to providing loan services for businesses, but also offers solutions for farmers, livestock breeders, and fishermen in Indonesia to obtain financial access for business development in the agricultural, fisheries, and livestock sectors.

This startup application in Indonesia has been integrated with TaniHub, a digital agricultural e-commerce platform that is ready to distribute harvests to hundreds of buyers spread across traditional markets, catering, restaurants, and many more.

It can be said that this application is an Indonesian startup company that can provide loan services specifically for people who work in these fields.

6. T-Cash

One of the financial technology startups in Indonesia that not only provides convenience for purchasing credit, but now many users can also use it for shopping, sending money, paying bills, and paying merchants.

There are now many merchant options that have joined and conducted transactions through this startup.

For users, there is no need to worry about legality because the application itself has obtained direct permission from Bank Indonesia, which will certainly provide benefits in facilitating more practical and economic transactions.

See Also: Easier, Automatic, and Real-Time Transactions with API Disbursement

Those are some choices of financial startups that have been implemented in Indonesia, which certainly provide benefits for every user who uses them.

These choices can certainly be tailored to the needs of conducting transactions or borrowing related to financial technology.

Use Jack for your business needs.

Those are some financial startups operating in Indonesia. Hopefully, this content can be useful for all readers.