KPIs, or Key Performance Indicators, primarily serve as metrics that measure how close a company is to achieving its business goals. However, just because a metric can be measured doesn’t mean it is relevant to the business.

This is a common mistake made by many companies. Tracking too many data points can be detrimental and deviate from the main purpose of KPIs, which is to provide focus. KPIs should not only be quantitative but also specific.

How can we avoid common mistakes in developing KPIs? Let’s first understand the definition, important types of KPIs, and examples.

Definition of KPIs

According to Investopedia, Key Performance Indicators (KPIs) are quantitative measures used to assess the long-term performance of a company as a whole. KPIs can indicate how effective a company is in achieving its primary business goals.

Creating KPIs usually aligns with the current situation in the industry and can help companies make data-driven decisions.

For example, an e-commerce business may set KPIs for customer satisfaction using the Net Promoter Score (NPS) metric. NPS calculations are typically done by surveying customers and asking them to rate on a scale of 1-10 their likelihood of recommending the company’s products to friends or acquaintances.

The higher the score, the more likely customers are to show loyalty to the product, including voluntarily promoting the brand to their close contacts. If the NPS consistently remains high, the company can make decisions to maintain the current strategies, improve loyalty programs, or allocate additional resources to enhance customer satisfaction.

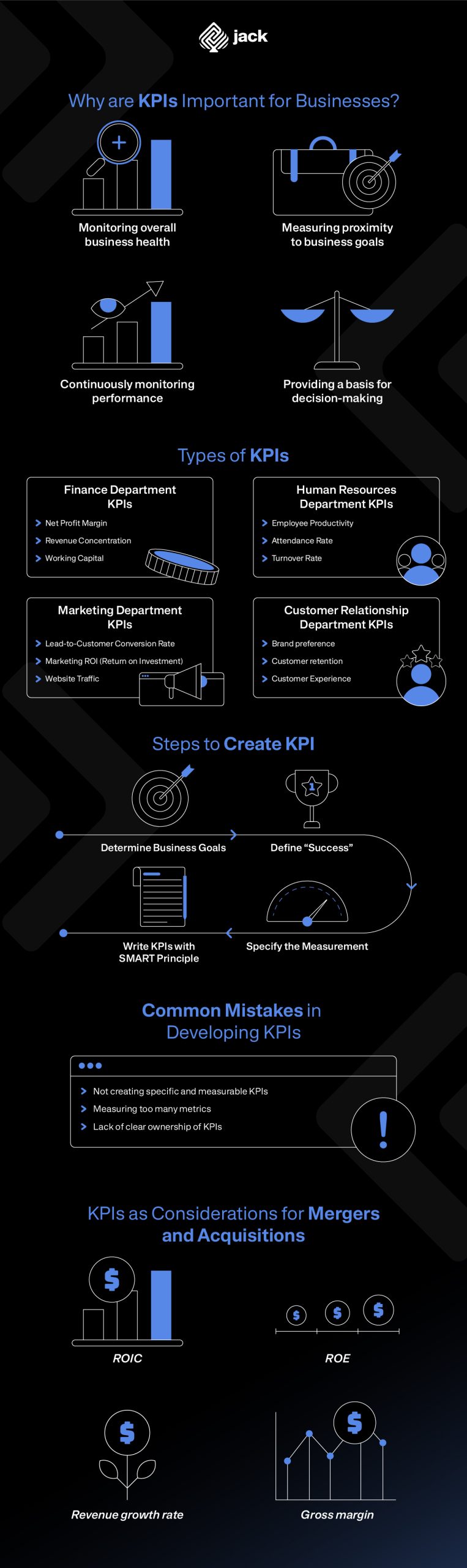

Why are KPIs Important for Businesses?

1. Monitoring overall business health

KPIs provide concrete measurements of the overall health of a business. With KPIs, businesses can identify three key aspects related to sustainability: employees, customers, and revenue.

2. Measuring proximity to business goals

KPIs provide a way to objectively measure business performance. By having relevant and measurable KPIs, businesses can monitor their progress over time and evaluate their achievements against set targets. KPIs can provide measurable results that indicate whether a business has achieved its goals, such as in terms of revenue, gross margin, product quality, employee productivity, and more.

3. Continuously monitoring performance

KPIs enable ongoing monitoring of business performance. By regularly observing KPIs, businesses can identify issues or opportunities early on, allowing them to take necessary actions to rectify or capitalize on the situation.

4. Providing a basis for decision-making

KPIs provide valuable data and insights for decision-making. With accurate information, businesses can make better decisions based on evidence and analysis, thereby improving their performance and achieving business goals.

Types of KPIs

Fundamentally, KPIs are created in numerical form, but not all KPIs are related to the financial performance of a company. In this article, the division of KPIs will be explained based on the respective departments:

Finance Department KPIs

Financial KPIs are important for monitoring the financial health of a company. According to FreshBooks, here are some metrics that can be used as benchmarks in setting KPIs for the finance department:

1. Net Profit Margin

Net profit margin is a crucial metric to assess the profitability of a business. It measures how much profit a company generates after deducting expenses from revenue. The net profit margin can be calculated using the formula:

Net profit margin = (net income / revenue)

2. Revenue Concentration

Revenue concentration helps companies identify the proportion of revenue generated by each customer or project. By using the revenue concentration metric, businesses can determine the Return on Investment (ROI) for each customer. The revenue concentration can be calculated using the formula:

Revenue concentration = (revenue by customer / total revenue) * 100

3. Working Capital

Working capital represents the cash used by a company to meet short-term financial obligations. It is essential for the day-to-day operations of a business. Understanding the calculation of working capital can help a company plan strategic steps for the future.

For example, if a company plans to hire new employees for business expansion within the next year, understanding working capital becomes crucial.

Working capital = current assets - current liabilities

Human Resources Department KPIs

Performance and employee satisfaction can be measured using the following metrics:

1. Employee Productivity

Employee productivity measures the output or work generated by employees. It can be calculated by dividing the total output by the number of employees.

2. Attendance Rate

Attendance rate measures the percentage of employees present during scheduled work hours. It can be calculated using the formula:

Attendance rate = (number of workdays attended / total workdays) x 100%

3. Turnover Rate

Turnover rate measures the percentage of employees who leave the company within a specific period. It can be calculated using the formula:

Turnover rate = (number of employees who left / total employees at the beginning) x 100%

Marketing Department KPIs

Marketing KPIs are crucial for evaluating marketing strategies and identifying areas for improvement. Here are some metrics that can be used:

1. Lead-to-Customer Conversion Rate

This metric measures the percentage of leads successfully converted into customers. It can be calculated using the formula:

Lead-to-customer conversion rate = (number of new customers / number of leads) x 100%

2. Marketing ROI (Return on Investment)

Marketing ROI measures the relative profitability obtained from marketing investments. It can be calculated using the formula:

Marketing ROI = ((Revenue generated - Marketing cost) / Marketing cost) x 100%

3. Website Traffic

Website traffic measures the total number of visitors to a company’s website within a specific period.

Customer Relationship Department KPIs

Performance measures related to customer relationships fall under the non-financial category of KPIs. These KPIs monitor the customer perspective through various metrics:

1. Brand Preference

Brand preference indicates the extent to which a brand has a more favorable impression compared to its competitors. Positive brand preference may reflect high customer satisfaction with the product or service.

2. Customer Retention

Customer retention measures how many customers make repeated purchases. However, tracking when a customer stops using a product or service can be challenging, especially for businesses that offer subscription-based services.

3. Customer Experience

Customer experience metrics assess various areas where customers directly interact with the company, such as customer service. Evaluating customer experience helps measure how well the company is meeting customer expectations.

Steps to Create KPI

The best KPIs for each business depend on the specific business goals. Therefore, identifying the main strategic objectives is the first and most important step in developing KPIs. There are at least four stages that need to be followed to create ideal KPIs:

1. Determine Business Goals

Start by understanding the overall business goals and identify the most important areas to prioritize. This helps determine the focus of the KPIs to be created.

2. Define “Success”

Success has different meanings for every business. Therefore, identify key indicators that can measure progress and success in achieving the established business goals. Ensure that the chosen indicators can be objectively measured and are relevant to the desired objectives.

3. Specify the Measurement

The company needs to select metrics to make “success” something that can be measured. Ensure that the targets or figures to be achieved are realistic, measurable, and attainable within the specified timeframe.

4. Write KPIs with SMART Principle

Before starting to write KPIs, make sure to use the SMART concept, which stands for specific, measurable, achievable, realistic, and time-bound.

The most important advice is to ensure that the KPIs are easily understood by everyone in the company. Avoid abstract jargon and write as succinctly as possible.

Common Mistakes in Developing KPIs

The issues a business faces may stem from its own KPIs. Many companies waste time by setting targets and metrics that are not relevant to their business goals. Here are some common mistakes to avoid when developing KPIs:

1. Not creating specific and measurable KPIs

Good KPIs follow the SMART principle (specific, measurable, achievable, realistic, and time-bound). However, many companies create vague and non-measurable KPIs.

For example, “Increasing business growth” is an abstract KPI that cannot be measured. Instead, companies can establish quantitative KPIs like “Increasing revenue from cold calling strategies by 25% in this fiscal year” or qualitative KPIs like “Improving customer satisfaction by 20% through monthly reward programs.”

2. Measuring too many metrics

With the help of advanced tools, tracking dozens or even hundreds of metrics has become easy and instant. However, just because something can be measured doesn’t mean it is relevant to the business goals. To avoid this mistake, always establish the overall business goals and targets before developing any KPIs.

3. Lack of clear ownership of KPIs

Each KPI should have a clear owner who is responsible for achieving the set targets. Assigning ownership ensures transparency and accountability from the beginning.

It is essential to have one person responsible for each KPI, even though others may work towards achieving it. By empowering one individual, communication and decision-making become much easier.

KPIs as Considerations for Mergers and Acquisitions

Companies employ various corporate strategies, including mergers and acquisitions (M&A). In M&A, certain financial metrics become considerations for selecting targets. Some financial metrics include:

1. Return on Invested Capital (ROIC)

ROIC measures the return on the capital invested. It indicates how effectively a company generates returns on its invested capital.

ROIC = net income / invested capital

2. Return on Equity (ROE)

ROE measures how efficiently a company generates profits for shareholders. It calculates the return on the shareholders’ equity.

ROE = net income / equity

3. Revenue Growth Rate

The revenue growth rate indicates the speed of a company’s growth. It is a common metric for startup companies and serves as a solid indicator of business growth.

Revenue growth rate = (revenue in month B - revenue in month A) / revenue in month A * 100

4. Gross Margin

Gross margin measures a company’s ability to cover the cost of goods sold. It is calculated as the difference between net sales and the cost of goods sold.

Gross margin = net sales - cost of goods sold

Example Calculation of KPI

A positive sales growth rate percentage reflects overall successful sales strategies, while a negative result indicates errors in the current strategy that need improvement.

For example, a skincare brand launches a new product in Q2. During that period, the new product generates net sales of IDR 100,000, which is lower than the sales in Q1 of IDR 110,000. In other words, the sales growth rate is calculated as -9.09%.

This indicates that the sales performance did not yield positive results despite the innovation of launching a new product. By tracking and calculating the sales growth rate, the company can take steps such as reverting to the previous product and optimizing quality and promotional campaigns.

As discussed, KPIs have two main types: financial KPIs and non-financial KPIs. However, there are numerous derivations within these categories that are not all covered in this article.

See also video tutorials from financial and business from Jack.

Use Jack for your business needs

One important consideration is to choose relevant KPIs aligned with business goals. Not all metrics need to be included as KPIs for a company.