Tax is an unavoidable aspect of the business world, and to ensure transparency and compliance, governments establish strict tax regulations. One crucial element in tax administration is the Tax Invoice Serial Number (TISN).

Definition of Tax Invoice Serial Number

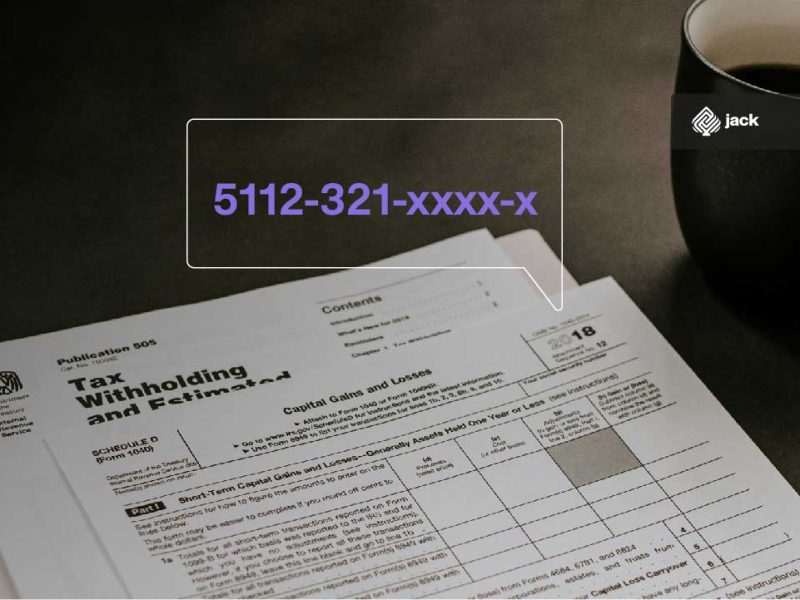

The Tax Invoice Serial Number (TISN) is a unique combination of numbers and letters assigned by the Directorate General of Taxes (DGT) to every tax invoice issued by businesses.

The tax invoice itself is an official document that records transactions involving the sale of goods or services, and the TISN serves as an identifier that distinguishes each transaction.

The tax invoice serial number is not just a combination of printed numbers on an invoice. The TISN reflects the identity of the transaction. Each digit and letter in the serial number carries specific meanings, such as the region code, year of issuance, transaction type, and invoice number.

Therefore, the TISN is not only an ordinary administrative tool but also a key to understanding the history and characteristics of each transaction.

The Importance of Serial Numbers for Tax Compliance

The Tax Invoice Serial Number is essential for several main reasons. Firstly, it aids the government in monitoring and controlling tax activities. By having recorded serial numbers, the Directorate General of Taxes can accurately track each transaction, ensuring that every business complies with applicable tax obligations.

Additionally, tax invoice serial numbers play a role in preventing unlawful tax practices. The presence of TISN makes it difficult for businesses to create fake invoices or overlook their transactions. This helps create a fair business environment and encourages tax compliance.

Structure of the Tax Invoice Serial Number

To better understand TISN, it is important to know its basic structure. Each part of the serial number carries specific information about the transaction.

For instance, the region code at the beginning of the serial number reflects the location of the invoice issuer. This helps in determining the tax obligations applicable in that region.

The year of issuance provides information about the age of the transaction, and the transaction type includes whether the invoice is from the sale of goods, services, or other types of transactions. The invoice number is the unique identification for each transaction, ensuring there are no gaps or duplications.

A. How Tax Invoice Serial Numbers Are Designed:

Tax Invoice Serial Numbers are carefully designed by the Directorate General of Taxes (DGT) to provide specific information about each tax transaction. The structure of TISN may vary in each country, but it generally includes key elements that give a unique identity to each invoice.

TISN typically consists of a combination of numbers and letters, with each character holding a specific meaning. Essentially, the TISN contains information about the issuer’s location, year of issuance, transaction type, and invoice number. This provides a profound understanding of the origin and characteristics of each tax transaction.

B. Identifying Key Elements in the Serial Number:

1. Region Code

TISN often starts with a region code. This code reflects the physical location of the invoice issuer. In the context of taxation, it assists in determining the tax obligations applicable in that region.

2. Year of Issuance

The next element is the year of issuance. This information provides an overview of how relevant the transaction is within a specific time period. Understanding the year of issuance helps business owners ensure compliance with tax regulations.

3. Transaction Type

The next code in TISN covers the transaction type. Whether the invoice is from the sale of goods, services, or other transaction types, this provides a clear classification related to the characteristics of the transaction.

4. Invoice Number

The invoice number is the last part of TISN and provides a unique identification for each transaction. This number must be sequential and without gaps, avoiding potential confusion or issues during tax audits.

Optimizing the Use of Tax Invoice Serial Numbers

Understanding the structure of TISN is not just about compliance but also about optimizing its use in day-to-day business activities.

1. Invoice Management System

Business owners can optimize the use of TISN by implementing an effective invoice management system. Automating the invoice issuance process can help reduce the risk of human errors and ensure that each invoice has the correct serial number.

2. Technology Integration

The adoption of technology, such as e-invoicing systems, can facilitate the management of TISN. Business owners may consider adopting this technology to enhance efficiency and accuracy in tax administration.

See Tutorial Account Verification Jack

The Importance of Understanding Tax Invoice Serial Number Regulations

The Tax Invoice Serial Number is more than just a series of numbers and letters on an invoice. It is a crucial pillar of tax compliance that every business owner must understand and adhere to. A profound understanding of the regulations related to TISN is an absolute obligation, and here are the reasons why this is crucial:

Tax Transparency

TISN creates transparency in every business transaction. By understanding and complying with TISN regulations, business owners can ensure that every transaction is well-documented, providing a clear picture to authorities about their business activities.

Legal Compliance

Compliance with tax regulations is a legal obligation. TISN is not only an administrative tool but also an instrument to ensure that every business operates in accordance with the applicable laws.

Monitoring and Oversight

TISN helps the government monitor and oversee tax activities. By understanding the regulations related to TISN, business owners can ensure that they not only fulfill tax obligations but also contribute positively to government supervision and tax control.

Use Jack for your business needs

The Tax Invoice Serial Number is not just a combination of numbers and letters but a key element in running a tax-compliant business. Understanding every aspect of TISN, from its structure to its implications in business operations, is a strategic step in maintaining the sustainability and integrity of a company.