Bond mutual funds are a type of mutual fund that invests in bonds or debt securities issued by governments or companies. Bonds are financial instruments that offer fixed interest payments to bondholders over a specified period and repayment of the principal at maturity.

The working mechanism of bond mutual funds is considered a relatively safe and stable investment choice, as bonds are generally seen as lower-risk compared to stocks.

There are several benefits to investing in bond mutual funds that investors need to understand and know. This will help them feel confident when choosing this type of investment. This article will explain these benefits and provide an overview of how bond mutual funds work to generate returns.

Important Benefits of Choosing Bond Mutual Funds

Choosing the right investment is crucial, and understanding how bond mutual funds work is essential. This investment instrument offers many benefits for investors who opt for it. The following are some of the key benefits:

1. Provides Potential for Steady Income

Investing in bond mutual funds offers regular fixed income in the form of interest paid periodically to investors. This provides a reliable source of income, especially for those seeking lower-risk investments. For investors looking for comfortable passive income, choosing this type of investment can be advantageous.

2. Portfolio Diversification

Investing in bond mutual funds allows investors to diversify their portfolios by allocating their funds to various types of bonds. This diversification aims to reduce investment risk and increase potential returns, enabling investors to achieve maximum results from their chosen bond mutual fund investments.

3. Liquidity

Bond mutual funds have a relatively high level of liquidity, allowing investors to buy and sell fund units daily at market prices. This flexibility enables investors to withdraw their investments as needed, making it an attractive option for those seeking ease in accessing their investment funds.

General Working Mechanism of Bond Mutual Funds

In addition to the benefits mentioned, it is essential for investors to understand how bond mutual funds generally work. This knowledge will help them make confident investment choices. Here are five general ways in which bond mutual funds operate in the Indonesian investment market:

1. Purchasing Bonds

Bond mutual fund managers purchase bonds issued by governments or companies. They consider the bond’s quality, interest rate, investment period, and associated risks when making these purchases. Fund managers typically provide insights into which bonds are suitable for investors.

2. Portfolio Management

Bond mutual fund managers manage the investment portfolio by selecting bonds that align with the fund’s investment objectives and risk profile. They also diversify the portfolio to reduce risk and enhance potential returns. Effective portfolio management helps minimize risks and maximize benefits for investors.

3. Interest Income

The bonds held by bond mutual funds generate interest income according to the prevailing interest rates. This interest becomes part of the fund’s income and is distributed to investors based on the number of units they hold. Generally, the interest value is predicted from the start, providing investors with expected returns.

4. Performance Monitoring

Bond mutual fund managers continuously monitor the portfolio’s performance, including the bonds’ performance and market conditions. They evaluate the investment results and take necessary actions to optimize the portfolio’s performance, reducing the risk of losses and increasing the likelihood of gains.

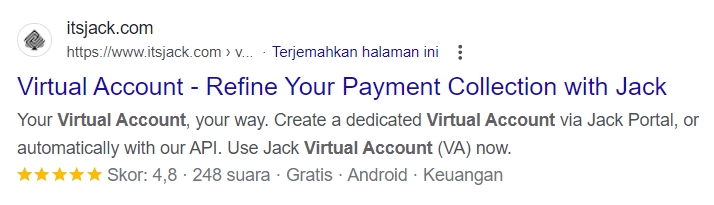

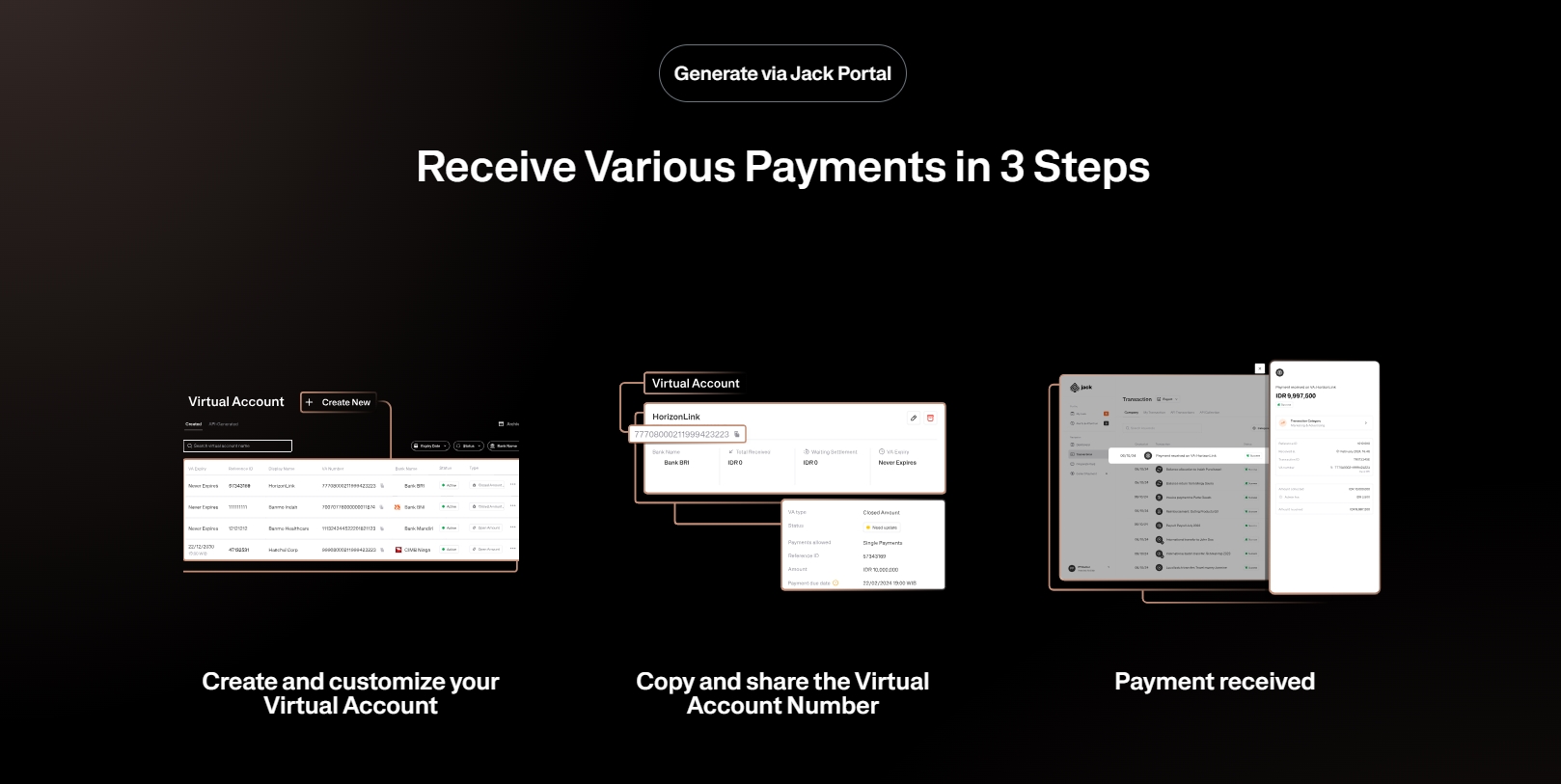

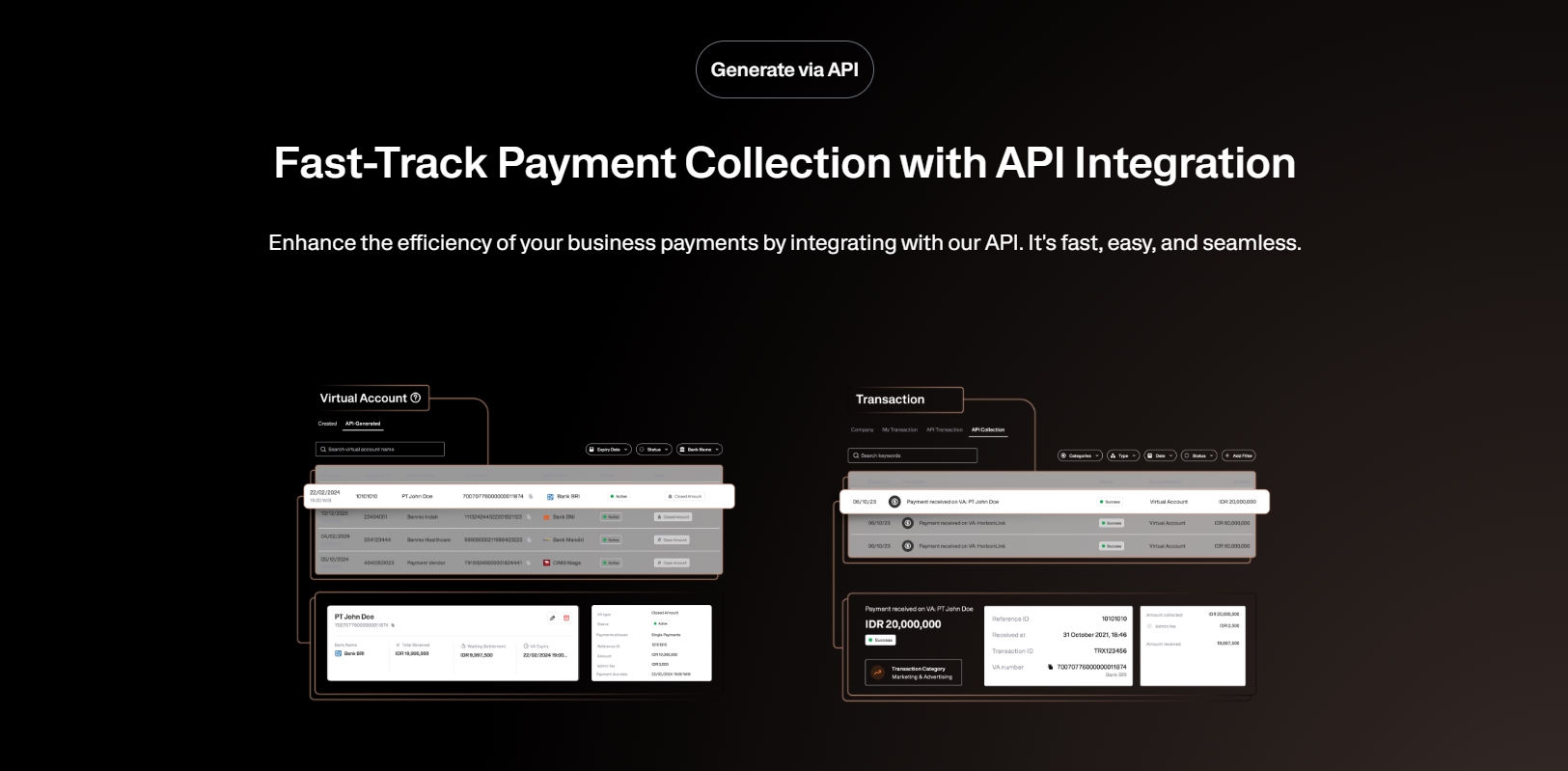

See the API Document from Jack Finance here

5. Profit Distribution

Profits from bond mutual fund investments are distributed to investors based on the number of units they own. This distribution is done proportionally and transparently, following the applicable regulations.

Spend with Flexibility, Anywhere with Jack

This transparent profit distribution aligns with investors’ expectations when choosing bond mutual funds.

Use Jack for your business needs

With a professional, transparent, and investor-focused working mechanism, bond mutual funds are an attractive investment option for those seeking lower-risk investments that still offer stable returns. Investors should understand how bond mutual funds work before deciding to invest, ensuring they achieve the projected benefits within the specified timeframe.