In the world of finance and accounting, the terms “gross profit” and “net profit” are often important topics of discussion. However, not everyone understands the fundamental differences between the two.

This article will detail the differences between a company’s gross profit and net profit and the importance of understanding these concepts in financial analysis.

Definitions and Components of Gross Profit and Net Profit

Gross profit and net profit are two critical financial concepts in analyzing a company’s financial statements. Although often used together, they have significant differences in meaning and usage.

1. Definition and Components of Gross Profit

Gross profit is the total revenue of a company after deducting direct costs associated with the production of goods or services sold. These direct costs include raw materials, direct labor, and production overhead costs.

Gross profit reflects the profitability of the company’s core operations without considering additional costs such as marketing, administrative, or interest expenses.

a. Total Revenue

The total revenue obtained from selling goods or services before deducting returns or discounts.

b. Cost of Raw Materials

Expenses incurred to acquire the raw materials needed in the production process.

c. Direct Labor Costs

Wages paid to workers directly involved in the production of goods or services.

d. Production Overhead Costs

Fixed and variable costs directly related to the production process, such as machinery depreciation, electricity costs, and maintenance costs.

2. Definition and Components of Net Profit

Net profit is the total revenue of a company after deducting all operational expenses, including overhead, interest, taxes, and other costs.

Net profit reflects the overall profitability of the company after considering all expenses related to operations and finance.

a. Total Revenue

The company’s total revenue after deducting returns, discounts, and allowances.

b. Operational Expenses

Expenses related to the company’s operations, including marketing, administrative, and research costs.

c. Interest Expenses

Interest payments on the company’s debts.

d. Taxes

Taxes paid by the company on the income earned.

8 Differences Between Gross Profit and Net Profit of a Company

Although they may sound similar, there are significant differences between them. In this article, we will closely examine eight key differences between a company’s gross profit and net profit.

1. Main Components

The main component of gross profit is the revenue from the sale of goods or services minus the direct costs associated with producing the goods or providing the services. Net profit consists of total revenue minus all types of expenses incurred by the company.

2. Impact of Costs

Only direct costs related directly to production are accounted for in gross profit. These costs do not include overhead or other operational expenses. Net profit accounts for all types of costs, including production costs, operational expenses, interest expenses, and taxes.

3. Performance Understanding

Gross profit provides an overview of the efficiency of the production process and the company’s ability to generate revenue from its operations. Net profit offers a more comprehensive picture of overall financial performance, as it takes into account all types of expenses involved in the company’s operations.

4. Tax Level

Taxes are usually not considered in gross profit since gross profit is calculated before considering taxes. Taxes are an important component in calculating net profit because net profit is the profit after taxes are considered.

5. Decision-Making Suitability

Gross profit is more suitable for use in internal company analysis to understand operational efficiency and identify areas where production costs can be reduced. Net profit is more useful in evaluating the company’s overall performance and predicting potential future profits.

6. Investment Viability Indicator

For investors interested in the production aspects of a company, gross profit can provide insights into potential profit margins. For investors who want to understand the net profit they can gain from their investment, net profit is the main indicator.

7. Investors and Shareholders

While not very common, some investors may be interested in gross profit to gain insights into the core business operations. For investors and shareholders, net profit is a more relevant metric as it reflects the actual profitability of their investment.

8. Changes Over Time

Changes in gross profit are usually related to changes in sales volume or direct production costs. Changes in net profit can be influenced by broader internal and external factors, including market fluctuations and regulatory changes.

Importance of Understanding the Difference Between Gross and Net Profit in Financial Analysis

A good understanding of the differences between a company’s gross and net profit is crucial in financial analysis because they provide different insights into the company’s performance.

Gross profit provides an overview of the core profitability of the business operations without considering the impact of indirect costs. This helps management and investors understand how efficient the company is in generating its core products or services.

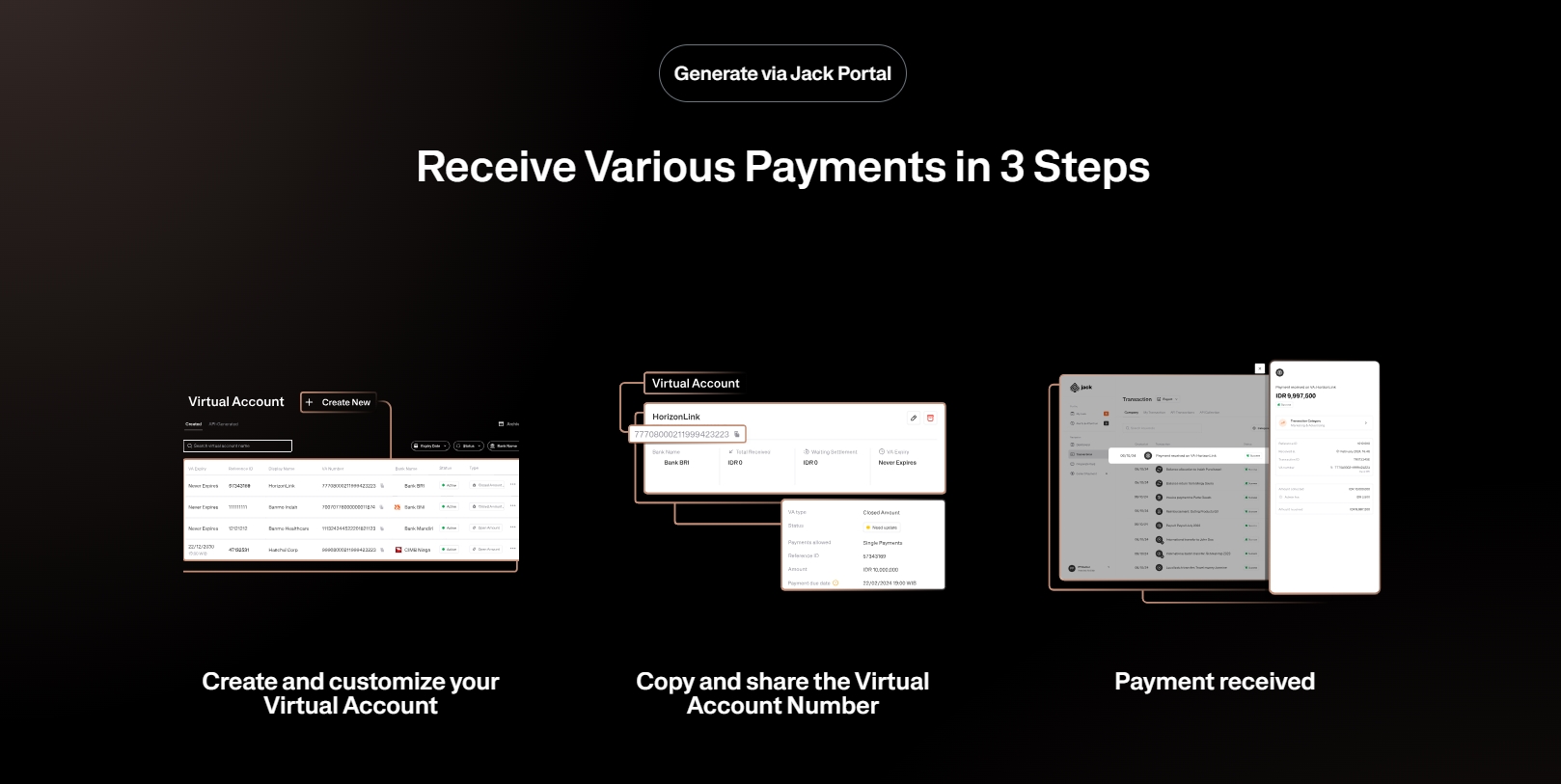

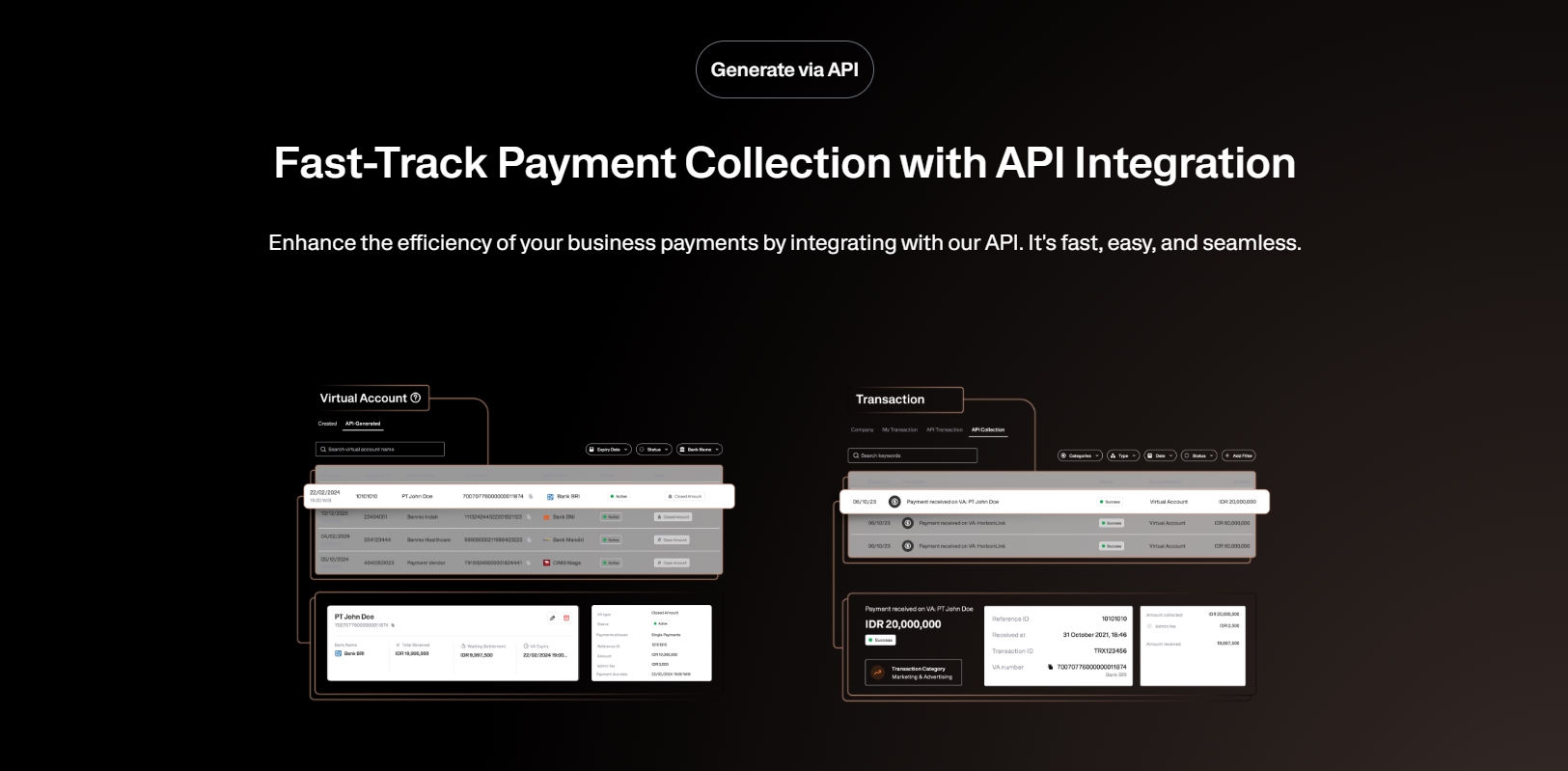

See the API Document from Jack Finance here

On the other hand, net profit provides a more complete picture of the final profit obtained by the company after considering all operational and other expenses. This is the actual profit available to be distributed to shareholders or reinvested into the business.

Use Jack for your business needs

Gross profit and net profit are two important concepts in financial analysis. Although they are often used interchangeably, they have significant differences in terms of components and their analytical implications.

By understanding the differences between them, investors and financial analysts can make more informed decisions and better business strategies.