The digital insurance revolution is transforming the insurance industry in today’s digital era. An industry long known for its slow and bureaucratic processes is now experiencing a significant transformation thanks to advancements in digital technology.

The digital insurance revolution brings significant changes in how insurance companies operate and interact with customers. This article will discuss how digital technology is changing the insurance industry landscape, the benefits it offers, and the challenges that need to be faced.

Evolution of the Insurance Industry

Before digital technology entered the insurance industry, the claims submission process took a considerable amount of time. Likewise, underwriting and policy sales often took a long time and involved many physical documents. Insurance agents had to meet customers face-to-face, and all administrative processes were done manually.

However, with technological advancements, the insurance industry has started to adapt and digitize. These technological advancements are evident in several areas such as the internet, big data, artificial intelligence (AI), and blockchain.

Technologies Driving the Digital Insurance Revolution

1. Internet of Things (IoT)

IoT devices like sensors in cars or homes can collect real-time data and provide accurate information about risks. This helps insurance companies determine more precise premiums and offer more personalized services.

2. Big Data and Analytics

Big data enables insurance companies to analyze large volumes of customer data to identify patterns and trends. Advanced analytics helps in more accurate risk assessment and fraud detection.

3. Artificial Intelligence (AI) and Machine Learning

AI is used to automate claims processing, underwriting, and customer service. Chatbots and virtual assistants can assist customers 24/7, providing a better experience and quicker response times.

4. Blockchain

Blockchain technology offers high data security and transparency in transactions. It can be used for identity verification, smart contracts, and immutable claims recording.

5. Mobile Technology

Mobile applications allow customers to purchase policies, file claims, and track claim status easily. The digital insurance revolution now makes it possible to access these services from mobile devices in a short time.

Benefits of the Digital Insurance Revolution

1. Ease of Access and Faster Processes

Digitization allows customers to access insurance services anytime and anywhere. The process of purchasing policies and filing claims becomes faster and more efficient.

2. Better Customer Experience

With online services and chatbots, customers can obtain information and assistance more quickly and easily. Personalizing services based on data analytics also increases customer satisfaction.

3. Operational Efficiency

Automating administrative processes and using AI reduces the need for manual work, saving time and operational costs.

4. More Accurate Risk Assessment

Real-time data from IoT and big data analytics enable insurance companies to assess risks more accurately, offering fairer and more competitive premiums.

5. Security and Transparency

Blockchain ensures customer data is secure and insurance transactions are transparent, reducing fraud risks and increasing customer trust.

Challenges in Digital Insurance

1. Data Security

With the increasing amount of data collected and stored digitally, the risk of data breaches and cyber-attacks also rises. Insurance companies must ensure strong cybersecurity to protect customer data.

2. Regulation and Compliance

Strict regulations in the insurance industry can pose challenges in adopting new technologies. Companies must ensure their digital insurance innovations comply with existing regulations.

3. Technology Adoption

Not all customers or insurance companies are ready to switch to digital solutions. There is a need for education and training so that all parties can effectively utilize this technology.

4. High Initial Investment

Implementing digital technology requires significant initial investments in infrastructure and system development. Insurance companies must be prepared to invest in the long term.

The Future of Digital Insurance

The digital insurance revolution is still in its early stages and continues to evolve. The future of insurance will increasingly be dominated by advanced technologies that offer more personal, efficient, and transparent services. Here are some trends likely to emerge in the future:

1. Increased Use of AI and Machine Learning

AI will play a more important role in automating processes, data analytics, and fraud detection. Machine learning will enable systems to learn and improve from collected data.

2. Development of More Personalized Insurance Products

With more detailed data, insurance companies can offer products tailored to individual needs, such as health insurance customized to the lifestyle and medical history of customers.

3. Usage-Based Insurance

With real-time data from IoT devices, insurance companies can offer premiums based on actual usage, such as car insurance premiums based on how often and safely someone drives.

4. Collaboration with Fintech

Insurance companies will increasingly collaborate with fintech to develop innovative solutions that combine financial and insurance services

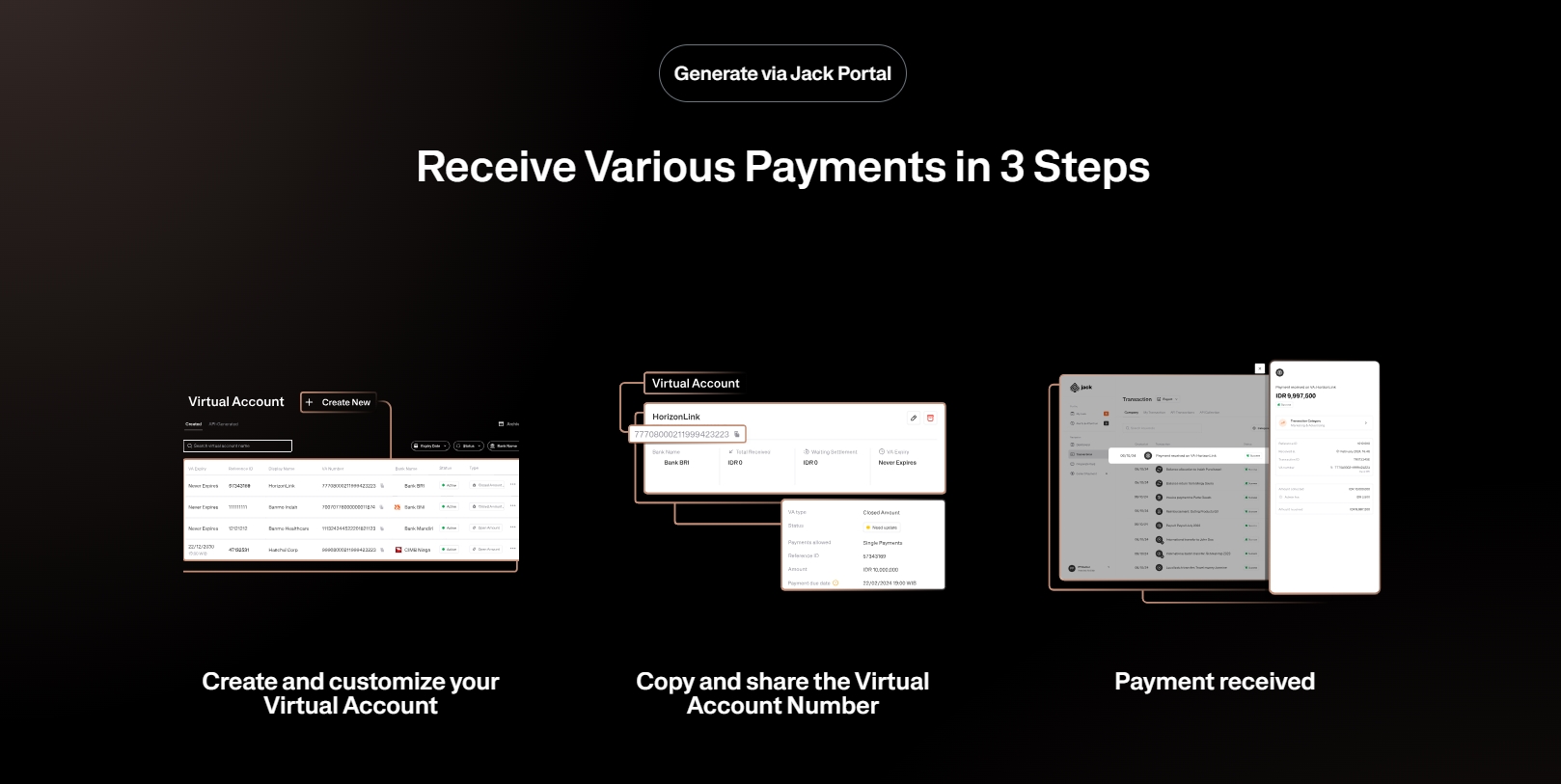

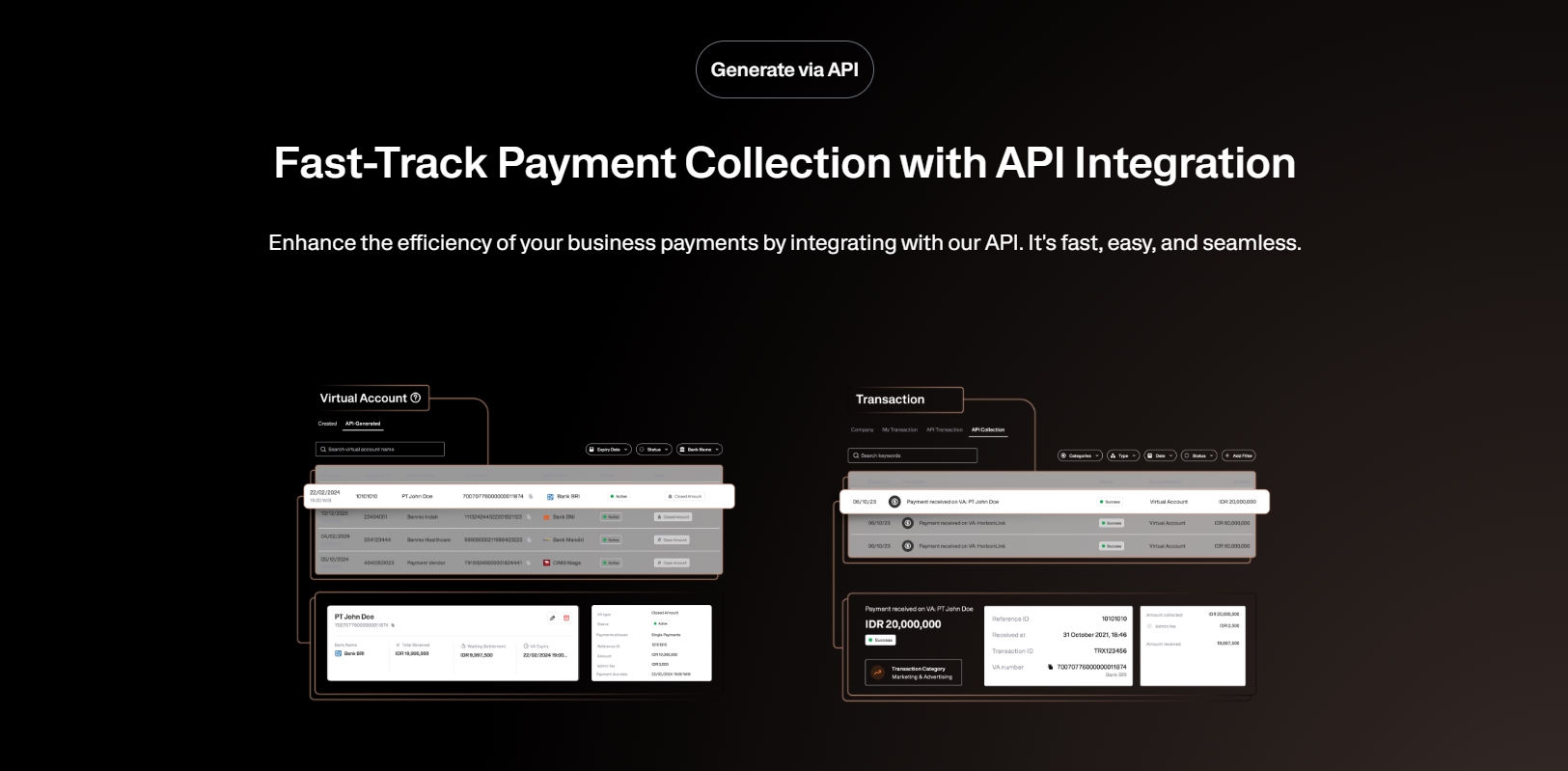

See the API Document from Jack Finance here

The digital insurance revolution is bringing a major transformation to the insurance industry, offering various benefits such as operational efficiency, better customer experience, and more accurate risk assessment. However, challenges such as data security, regulation, and technology adoption need to be addressed to maximize the potential of this technology.

Use Jack for your business needs

The future of the insurance industry will continue to evolve with technological advancements, providing increasingly sophisticated and personalized solutions for customers. With the right steps, digital insurance can become a cornerstone in risk management in this digital era.