Stock investment is a popular way to grow wealth and achieve long-term financial goals. However, optimizing stock investments requires the right strategies and steps. Many beginner investors do not understand the best ways to optimize their stock investments.

This article will discuss the ins and outs of stock investments, including their definition and benefits. Additionally, investors can gain insights on how to optimize their stock investments through the information provided below.

Understanding Stocks

Let’s start by understanding what stocks are. Generally, a security that represents ownership in a portion of the issuing company is called a stock, also known as equity.

Stocks are the fundamental units of ownership in a company and grant the owner rights to a certain percentage of the company’s assets and income, proportional to their stock holdings.

Stocks form the backbone of many individual investors’ portfolios and are primarily traded on stock markets. To protect investors from fraudulent activities, the government has implemented controls on stock trading. Essentially, selling shares is a common way for companies to raise capital.

Investors’ rights to a portion of profits and business assets are hallmarks of stock ownership. The ratio of an investor’s stock ownership to the total number of outstanding shares determines their ownership stake in the issuing company.

For example, if there are 1,000 outstanding shares, an individual with 100 shares would own 10% of the company’s assets and profits.

Benefits of Stock Investment

While there are many investment models to choose from, opting for stock investment offers unique benefits. Here are some general benefits you can gain from investing in and optimizing stock investments:

1. Potential for High Returns

Most investors put their money into stocks because of the higher returns they can achieve compared to other investment options like gold or government bonds. For instance, since 1926, the stock market has averaged a return of about 10% per year, while long-term government bonds have yielded around 5% to 6% per year.

2. Protects Money from Price Increases

It is common for stock market returns to exceed inflation rates by a significant margin. For example, inflation has averaged 3.1% per year since 1913, while annual equity returns have reached double digits. Thus, one approach to protecting funds against inflation is by investing in stocks.

3. Provides Consistent Passive Income

Many companies regularly distribute a percentage of their earnings to investors in the form of dividends. While some companies pay dividends monthly, most distribute them quarterly.

This makes stock investment beneficial as it can supplement fixed incomes such as salaries or pensions with dividend income from stock ownership.

Spend with Flexibility, Anywhere with Jack

How to Optimize Stock Investments

To maximize stock investments, it’s essential to have the right knowledge and strategies. Especially for beginner investors who often lack experience in this type of investment. Here are five ways to optimize your stock investments:

1. Conduct In-Depth Research

Before deciding to invest in specific stocks, it’s crucial to conduct thorough research and analysis of the company in question. Examine the company’s financial performance, growth prospects, and other factors that can influence stock prices. By conducting comprehensive research, investors can make smarter and potentially more profitable investment decisions.

2. Diversify Your Investment Portfolio

Diversifying your stock investment portfolio is a crucial step to reduce risk and increase potential returns. Avoid investing all your capital in a single stock; instead, spread it across multiple stocks from different industry sectors. A diversified portfolio can protect investments from sudden market fluctuations.

3. Monitor Market Developments Regularly

Continuously monitor stock market developments and news related to stock investments. This information can help investors make better and timely investment decisions. Stay updated with economic and political news that can influence the stock market, enabling a quick response to market changes.

4. Set Clear Investment Goals

Define your stock investment goals, whether for the short-term or long-term. By setting clear investment goals, investors can create more directed and effective investment strategies. Additionally, acceptable loss limits should be set to manage investment risks better.

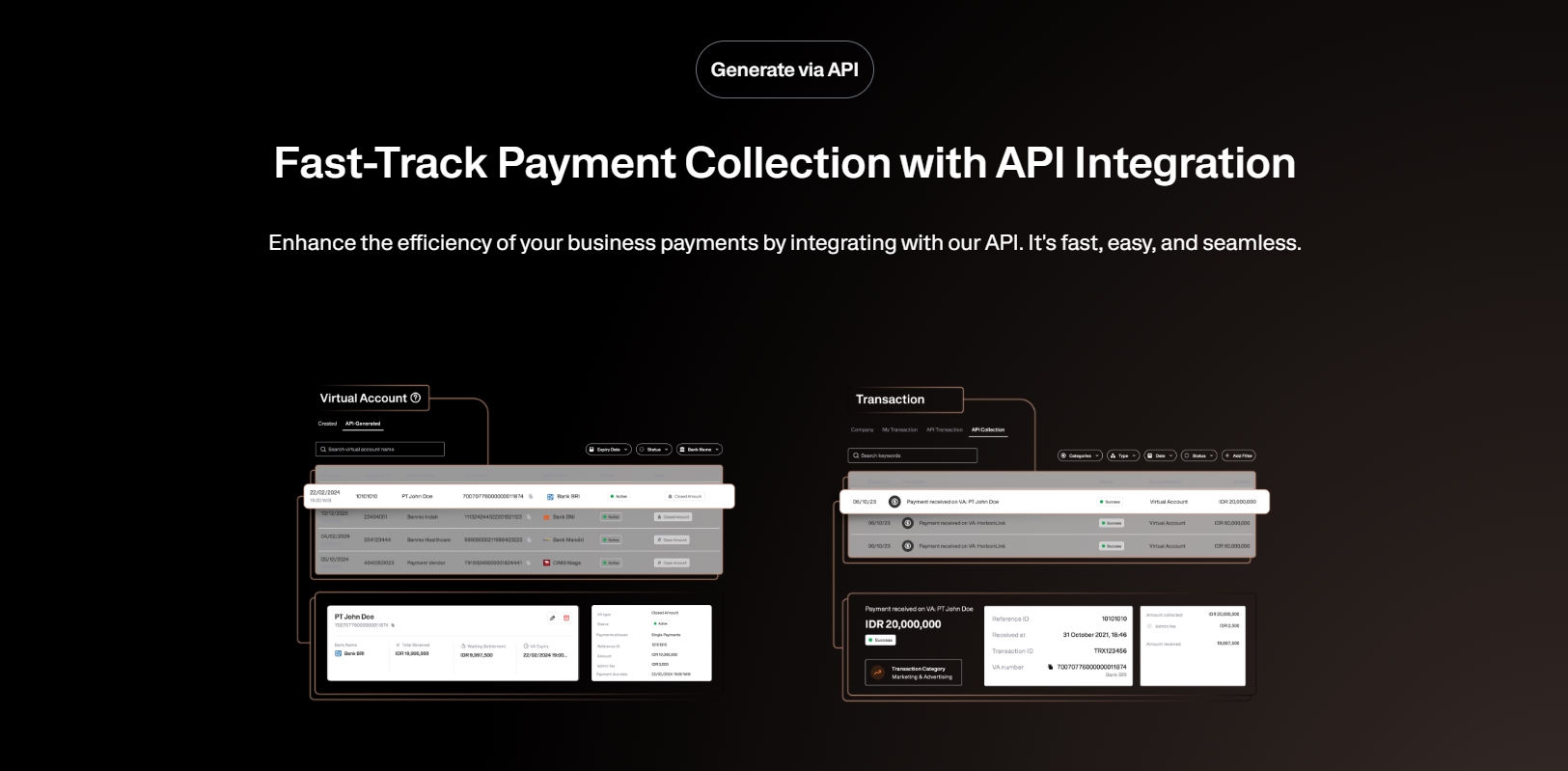

See the API Document from Jack Finance here

5. Be Consistent in Investing

Consistency in stock investing is crucial to achieving desired investment goals. Regularly allocating a portion of income to stock investments can help maximize returns. Regularly evaluate your investment portfolio and adjust your investment strategy according to current market conditions.

Use Jack for your business needs

By following these five steps, investors can optimize their stock investments and increase potential returns. Always remember to conduct thorough research and analysis before investing, and remain disciplined and consistent in executing the chosen investment strategy. May your stock investments succeed and provide satisfying results in the future.