Maximizing mutual fund investments can be achieved if you truly understand this type of investment. Today, mutual funds are one of the most popular investment instruments due to their ease of use and risk diversification.

See Also Corporate Credit Card: Definition, Types, Benefits, and How Cards Work for Startups

However, to achieve optimal results from mutual fund investments, the right strategy and knowledge are necessary. You need to understand various aspects related to this investment and then learn how to optimize mutual fund investments effectively.

Understanding Mutual Fund Investments

Mutual funds are popular investment instruments among the public due to their ease of investment and attractive profit potential. Mutual funds pool money from investors to invest in a portfolio managed by a professional fund manager.

This portfolio may consist of stocks, bonds, money market instruments, or a combination of these. Mutual funds allow small investors to access various investment instruments that might be difficult to reach individually.

Spend with Flexibility, Anywhere with Jack

Ways to Maximize Mutual Fund Investments

1. Understand the Types of Mutual Funds

Mutual funds come in several types, each with different characteristics and risks. Money Market Funds invest in money market instruments like deposits and Bank Indonesia Certificates (SBI), and short-term bonds, suitable for short-term investments with low risk.

Fixed-income funds invest in bonds, offering stable returns with relatively low risk. Mixed Funds combine investments in stocks and bonds, providing higher potential returns with medium risk. Equity Funds invest in stocks, offering the highest potential returns with high risk.

Understanding these types helps in choosing the right product according to your investment goals and risk profile.

2. Determine Investment Goals

Setting investment goals is a crucial step in optimizing mutual fund investments. Goals can include education funds, retirement funds, or buying property.

With clear goals, you can determine the investment period and the most suitable type of mutual fund. The goals could be long-term capital growth, generating additional regular income, or achieving ease and convenience in investment.

3. Diversify Investments

Diversification is a strategy to spread investments across various types of mutual funds to reduce risk. A diversified portfolio ensures that losses in one investment type are balanced by gains in another. Diversification can be based on mutual fund types or sectors such as technology, healthcare, finance, and consumer sectors.

4. Pay Attention to Costs and Fees

Each mutual fund product has different costs and fees, including purchase fees, redemption fees, and management fees. Pay attention to these costs as they can affect your investment returns. Choose products with reasonable costs that align with the services and benefits offered.

5. Evaluate Performance Regularly

Regularly evaluating the performance of your mutual funds is crucial to ensure that your investments align with your goals and expectations. Check the performance at least every six months or annually.

If the performance is not as expected, consider changing the product or adjusting your investment strategy. Compare performance with benchmarks or market indices to ensure it meets your expectations.

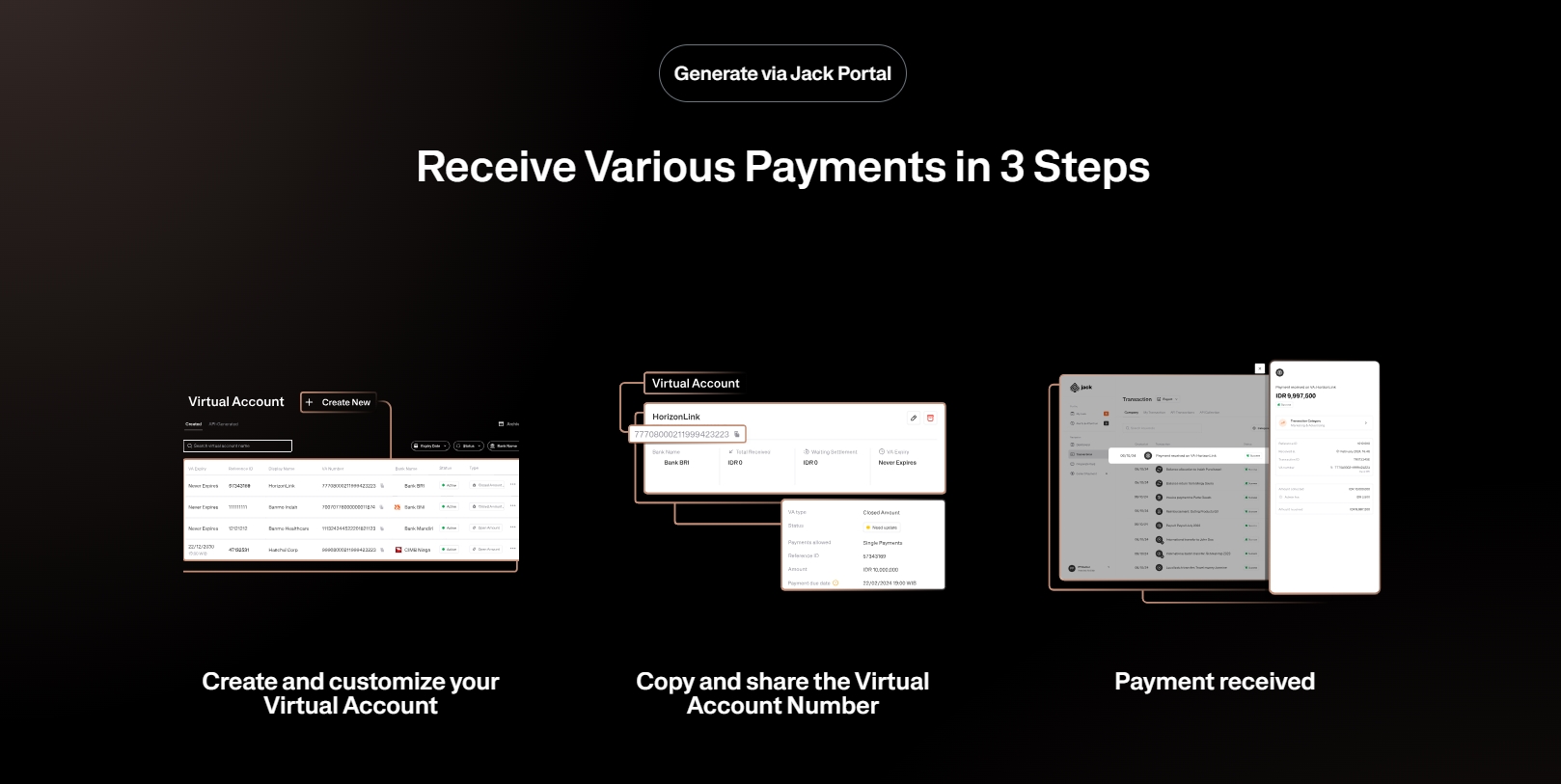

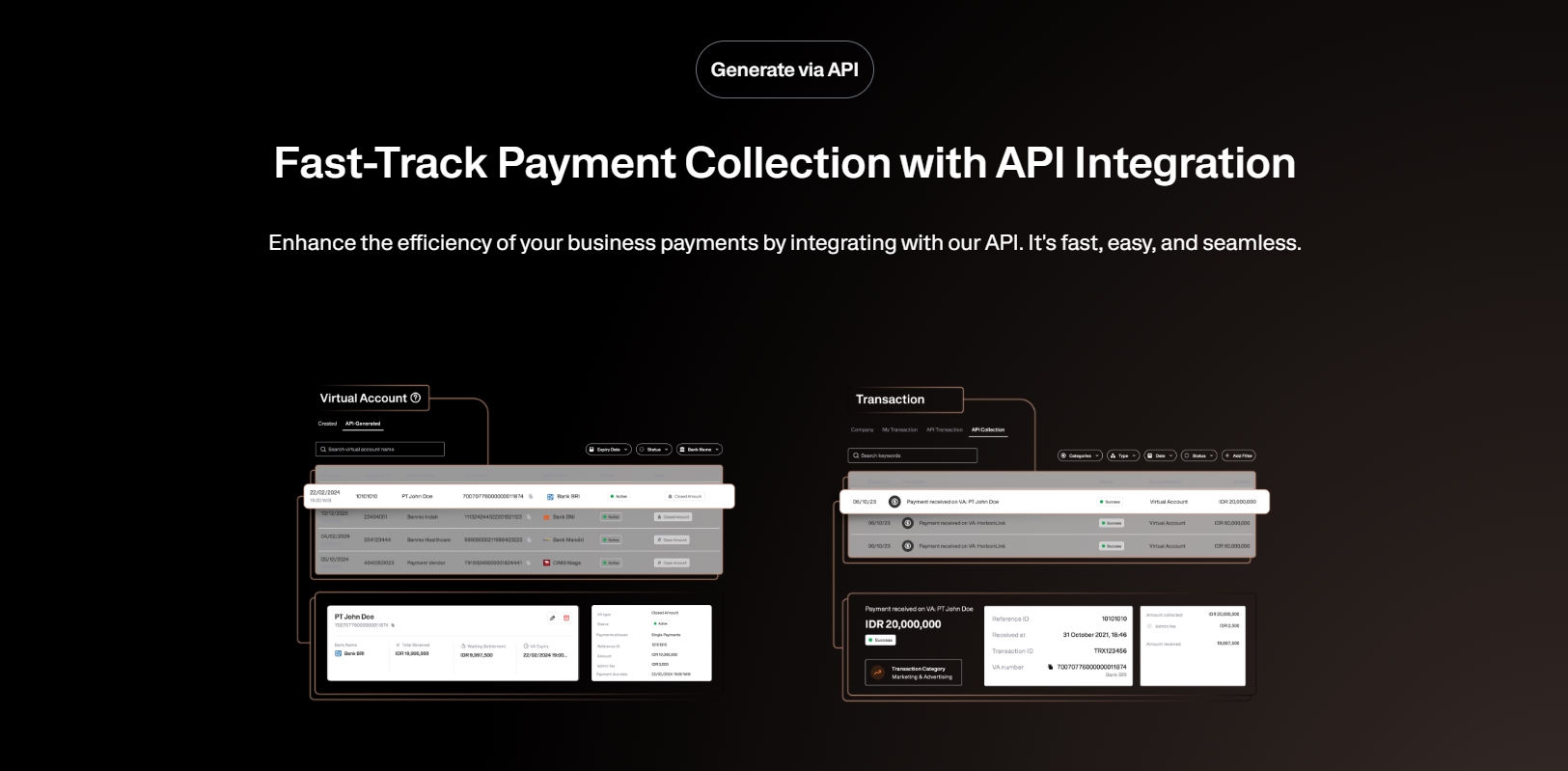

6. Leverage Technology

Many investment apps and platforms provide complete information on various mutual fund products and their performance. Utilize technology to get up-to-date information and make better investment decisions.

7. Consult Experts

If you are unsure or need assistance, do not hesitate to consult with financial experts or investment advisors. These professionals can provide advice tailored to your financial situation and investment goals. They will also help you understand the risks associated with each mutual fund type and align with your risk tolerance.

8. Be Disciplined and Consistent

Maximizing mutual fund investments requires discipline and consistency. Invest regularly using the Dollar-Cost Averaging (DCA) method, where you invest a fixed amount at regular intervals.

See the API Document from Jack Finance here

This approach helps reduce market risk and provides average returns over the long term. Avoid the temptation to withdraw investments suddenly unless in emergencies. Discipline in investing helps achieve long-term financial goals.

9. Monitor Economic and Market Changes

Stay updated with news and economic trends that can affect the investment market. This knowledge can help you make better decisions and adjust your investment strategy according to market conditions.

Use Jack for your business needs

Maximizing mutual fund investments is not difficult with the right strategy. Understand the types of mutual funds and set clear investment goals. With these steps, you can maximize the potential returns from mutual fund investments and achieve your financial goals.