Today, many people are looking for ways to invest their money, especially those who want to avoid high risks but still seek better returns than just a savings account. One attractive option is a money market mutual fund. This investment product is ideal for those aiming to grow their funds in the short term with relatively low risk.

In this article, we’ll help you decide if a money market mutual fund is right for you, by explaining what it is, its benefits and risks, and how to choose the best product based on your investment goals.

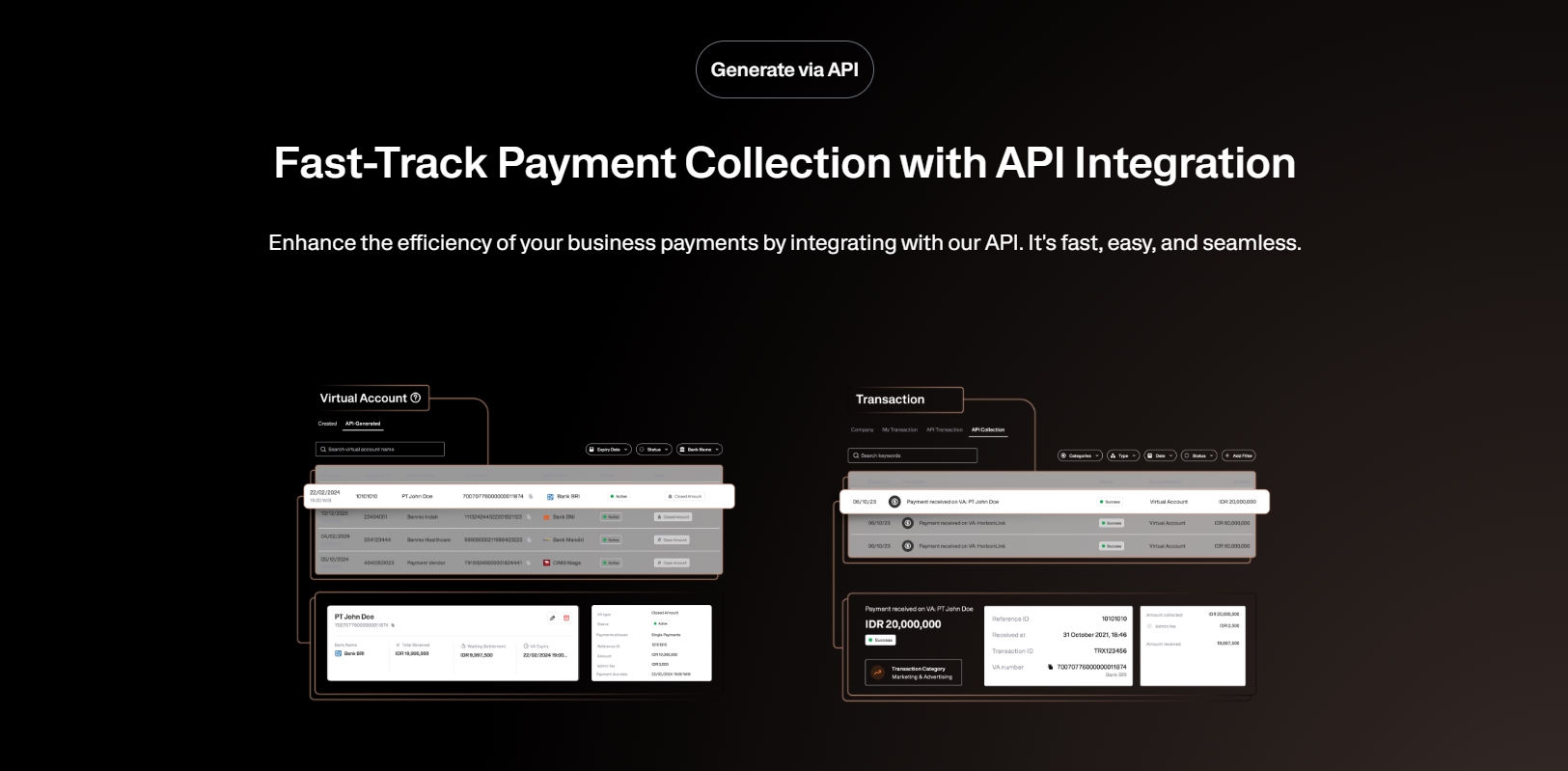

Also read: Easier, Automatic, and Real-Time Transactions with API Disbursement

What Is a Money Market Mutual Fund?

A money market mutual fund is a type of mutual fund that invests solely in money market instruments, typically with maturities of less than one year. These instruments include products like time deposits, government bonds, and short-term corporate bonds. Because of their low-risk nature, money market mutual funds are a popular choice, especially among beginner investors.

Unlike equity mutual funds, which carry high risks but potentially high returns, money market funds are more stable and secure. While the returns are lower than stocks, they still tend to outperform regular savings accounts.

See How Jack Can Support Your Business

Key Features & Benefits of Money Market Mutual Funds

Money market mutual funds offer several features that make them ideal for safer, more liquid investments. Here are the main advantages:

1. Lower Risk

Most instruments in these funds, such as Bank Indonesia Certificates (SBI) and government bonds (SBN), have extremely low default risk—perfect for conservative investors.

2. High Liquidity

Money market funds are highly liquid. You can withdraw your money quickly, often within a day. This makes them ideal for emergency funds or short-term needs.

3. Better Returns Than Savings

While they don’t match stock returns, they generally beat standard savings or time deposits, making them a compelling short-term option.

4. Low Starting Capital

With a starting investment as low as Rp10,000, money market funds are accessible for everyone, from first-time investors to seasoned ones.

Instruments in Money Market Mutual Funds

These funds allocate capital into secure and stable financial products. Common instruments include:

1. Time Deposits

These are bank deposits with set maturities. They typically offer higher interest than savings accounts and are short-term in money market funds.

2. Bank Indonesia Certificates (SBI)

Issued by Bank Indonesia, SBIs usually have a tenor of 1–3 months and offer attractive returns for money market funds.

3. Government Bonds (SUN)

These are government-issued securities to fund the national budget. Money market funds use short-term bonds for lower risk and better liquidity.

4. Short-Term Corporate Bonds

These are issued by private companies or SOEs. They offer better returns than deposits with relatively low risk compared to equities.

Pros and Cons of Investing in Money Market Funds

Like any investment, money market mutual funds have their pros and cons. Here’s what to consider before you decide to invest.

Pros

- Beginner-Friendly

Low risk makes it ideal for those just learning how to invest. - Higher Returns than Savings

More rewarding than a savings account, especially in the long term. - Highly Liquid

You can access your funds quickly for urgent needs.

Cons

- Inflation Risk

Returns may not keep up with rising inflation, potentially reducing your purchasing power. - Default Risk

Although rare, there’s still a chance the bond issuer may default. - Yield Fluctuation

Returns can slightly fluctuate depending on market conditions.

Tips to Choose the Right Money Market Mutual Fund

Ready to invest? Here are some things to consider before you decide on the right product.

1. Understand Your Risk Profile & Goals

Know whether you’re saving for an emergency fund, education, or another short-term goal, and choose accordingly.

2. Review Historical Performance

Past performance won’t guarantee the future, but it gives insight into the fund’s consistency.

3. Check Management Fees

Fees affect your returns, go for products with fair and transparent costs.

4. Diversify Your Portfolio

Even with low-risk options, diversification is key to optimizing returns and managing risk.

How to Start Investing in Money Market Mutual Funds

Getting started is simple, even for beginners. Here’s how:

- Choose the Right Platform

Find an investment platform that offers money market mutual funds and feels right for you. - Define Your Investment Goal

Decide if you’re investing for emergencies, education, or short-term needs. - Start Small

Begin with as little as Rp10,000. Keep an eye on fees, too. - Monitor Your Growth

Even stable funds benefit from periodic review.

Check out Jack Finance’s API documentation here

Use Jack for your business needs

However, it is advisable to conduct thorough research and consult with financial experts before investing in money market mutual funds. This ensures the investment aligns with your financial goals and risk profile, leading to satisfactory and targeted results.