Recurring payment is becoming increasingly popular and is now quite common among the public. With the development of digital business ecosystems, everything has become more convenient, including transactions that may require a recurring payment system. This system, also known as recurring payments, has spread widely and become a staple for many people.

See Also Corporate Credit Card: Definition, Types, Benefits, and How Cards Work for Startups

Many application platforms now use this type of payment system. However, some people may still not fully understand it. For those who want to learn more about this system, here is an explanation.

Definition of Recurring Payment

Recurring payment, also known as automatic payment, is a process where customers automatically make payments in the same amount for a product or service they receive and use at regular intervals.

This payment system is performed according to the customer’s choice and the platform’s offer, such as monthly or yearly. It is a payment method typically used in subscription services, like video streaming services, cloud services, or gym memberships.

How does Recurring Payment Work?

1. Initial Registration

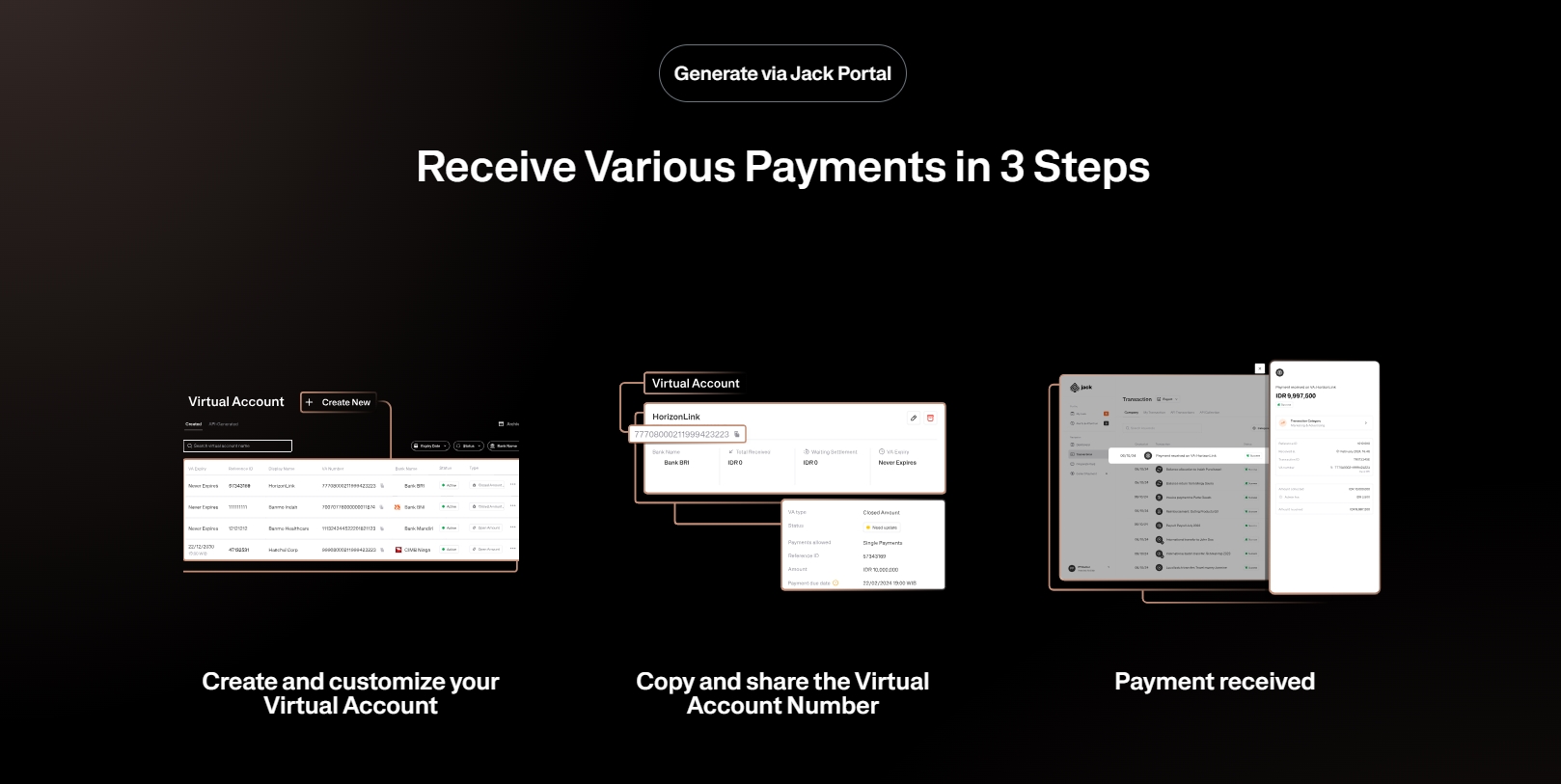

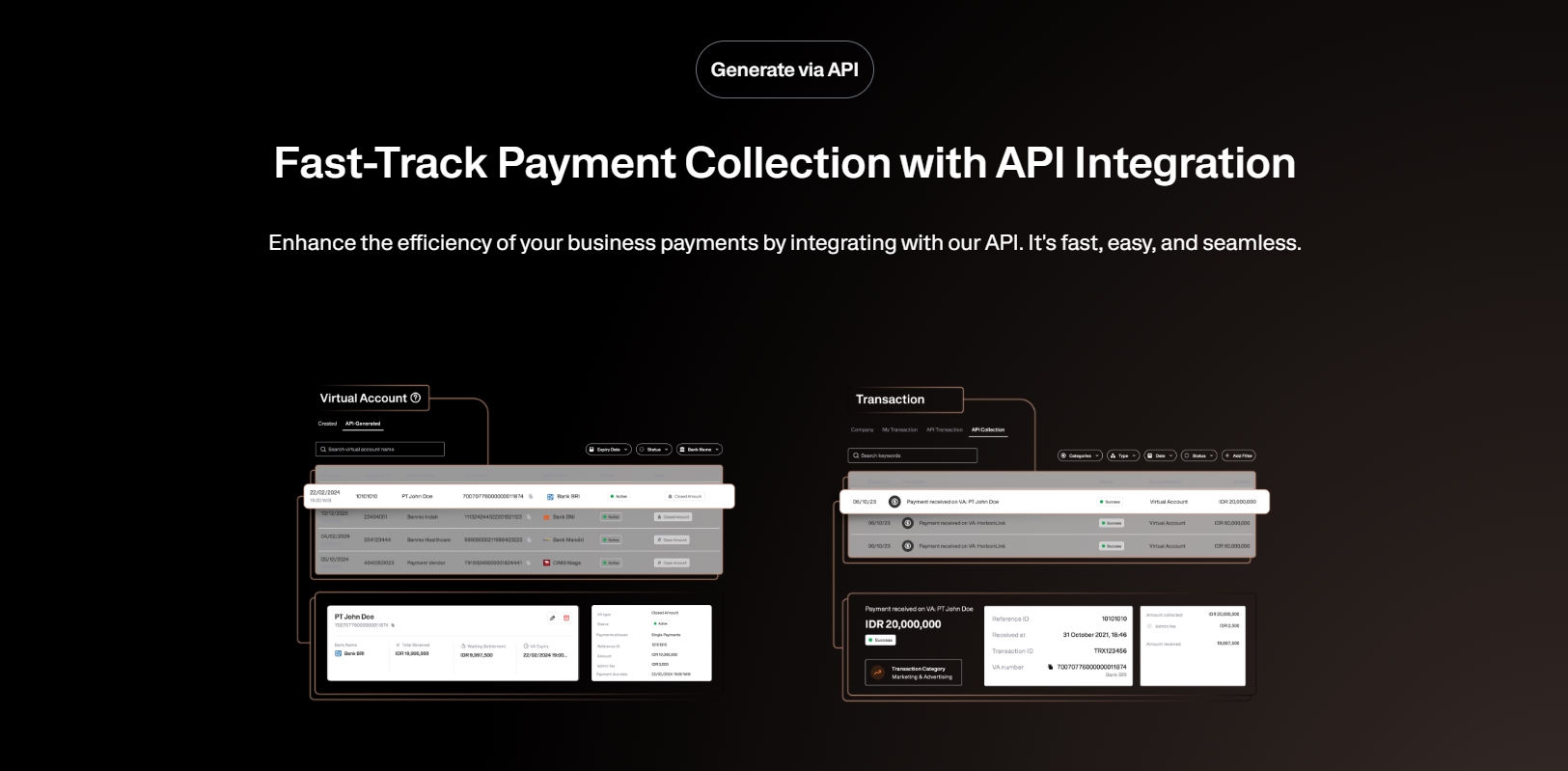

If you intend to implement a recurring payment system, several steps need to be followed. Initially, you need to register by providing information about the payment to be made, such as credit card details or bank account information and the frequency of payments.

2. Payment Process

Once registered for the recurring service, permission is granted to the service provider to automatically deduct the payment from the customer’s account at the specified time. The service provider will use this access to process payments accordingly.

3. Payment Schedule

The service provider will then provide a payment schedule based on the frequency chosen by the user, ranging from monthly to yearly. You can select the schedule according to your needs or preferences.

4. Automatic Process

On the specified date, the payment will be processed automatically without requiring a manual transaction each time. This can be done using a credit card, bank transfer, or other digital payment methods, based on the information provided to the service provider.

5. Payment Confirmation

The completed payment process will be followed by a confirmation, usually via email or other media. You can save or download this confirmation as needed.

Spend with Flexibility, Anywhere with Jack

Benefits of Recurring Payment

1. Customer Convenience and Satisfaction

Automatic recurring payments offer several benefits, mainly by making things easier for customers. It enhances customer satisfaction with the service, as they don’t have to worry about payment deadlines or handle manual payments each month. This creates a better and more convenient experience for the customer.

2. Financial Stability

Recurring payments also benefit businesses by maintaining financial stability. For service providers, this system ensures a steady stream of revenue, helping to plan budgets and growth strategies more effectively.

3. Customer Retention

Another benefit is increased customer retention. By simplifying the payment process and making it automatic, the likelihood of customers continuing their subscription increases. This convenience reduces the chances of cancellation and enhances customer loyalty.

Challenges of Recurring Payment

1. Customer Data Security

Despite its many benefits, recurring payments also come with challenges and concerns, particularly regarding customer data security. In today’s era, data breaches can be a significant issue. Therefore, it is crucial for service providers to secure customer payment information tightly.

2. Cancellation Policies or Price Updates

Another challenge involves ensuring that customers are aware of and understand the cancellation policies and potential price updates within the recurring service. This prevents unexpected surprises on their bank accounts or credit cards.

See the API Document from Jack Finance here

Recurring payment has become an integral part of the business model for many modern companies. Utilizing technology and advancements in digital systems, this payment method makes transactions easier for customers and enhances financial stability for service providers.

Use Jack for your business needs

However, it is essential to understand and manage the security and policy aspects related to recurring payments to ensure a positive customer experience. This fosters trust in the company and encourages customers to choose the recurring payment options offered.