One of the ways for a company to increase employee loyalty and their level of productivity is by providing rewards.

The types of rewards given can vary, ranging from promotions, vacation tickets, to the use of ESOP.

For those of you who are not familiar with ESOP, find out more information in this article, let’s go!

What is ESOP and How They Work?

ESOP stands for Employee Stock Ownership Plan, which is a company program that provides ownership of stocks to its employees. Through ESOP, employees can purchase company stocks or receive shares as compensation or incentives.

The amount of shares included in the program is determined by the company. Typically, the company will provide the shares by distributing them gradually over the years.

Moreover, employees cannot immediately sell the shares because they are subject to a vesting period. They can only sell them when they decide to resign or retire.

Usually, the company pays the shares to resigning or retiring employees in a lump sum or in monthly installments, similar to receiving a salary.

For retiring employees, the ESOP program can be beneficial if the stock price increases significantly compared to when the employee was first granted the ownership shares. This can result in substantial returns for the employee.

What is ESOP with Simple Example?

As mentioned earlier, ESOP is a company policy that grants employees the right to ownership through a stock ownership program in the company where they work.

In Indonesia, the concept of ESOP is regulated in Law No. 40 of 2007 concerning Limited Liability Companies, specifically in Article 43 paragraph (3). However, the detailed regulations and implementation methods are adjusted by each company.

This means that employees may receive shares at a price determined by the company at a specific time or depending on how long the employee has worked. If an employee meets the minimum required work period, they are entitled to receive a letter offering shares in the company.

To understand how investment rounds and ESOP (Employee Stock Ownership Plan) affect your ownership, let’s create a scenario where you, as the owner of the company, initially have 100% ownership. Then, you hire some staff, raise seed funding, proceed to series A funding, and further to series B funding. Afterward, two ESOP pools are created, targeting 10% ownership after each funding round.

- First Employee Recruitment

When starting a startup, you have 100% ownership as the founder. As time goes by, you need to hire a professional marketer to drive sales for the product or service your startup develops. Typically, startups allocate 5-10% of ESOP for early-stage employee recruitment. For example, if you choose to allocate 10% of ESOP to that employee, your ownership in the company will decrease from 100% to 90%.

- Seed Round

Next, as your startup grows and receives seed funding, investors usually request 10-25% of the startup’s equity to realize the planned business model. For instance, if the investor agrees to invest with a 10% equity share, your ownership will become 81%, the marketer will have 9%, and the investor will have 10%.

How are these numbers derived?

To calculate this, you multiply your previous ownership by the investor’s ownership percentage. So, 90% multiplied by 90% equals 81%, and for the staff, 90% multiplied by their 10% ownership equals 9%.

- Series A

If the seed funding successfully propels your startup to further growth, it is highly possible to obtain series A funding. For example, investors providing series A funding negotiate for a 20% ownership stake in your startup and demand a 20% ESOP allocation after the funding. However, you showcase your hiring plans and negotiate successfully, resulting in a smaller ESOP requirement of 10%.

Although investors agree to a 10% equity share, in reality, they will have a 12.5% ownership stake. Why? Because when the 10% ESOP pool is formed, everyone experiences a dilution of ownership by 12.5% to ensure the ownership becomes 0% after the investment.

Result: The founder now has 56.7% ownership (70.9% multiplied by 80%, which is 1 minus 20%), the engineer has 6.3%, the seed investor has 7%, the series A investor has 20%, and there is a 10% ESOP allocation after the funding. Overall, it adds up to 100%.

- Series B

Suppose your startup successfully secures series B funding, and the investor decides on a full 25% deal and requests a fixed 10% ESOP allocation. The calculation scheme for the shares becomes as follows: You increase the required 10% ESOP after funding by dividing it by 1 minus the investor’s 25% ownership. Then, you subtract the already owned 10% ESOP.

Now, since adding ESOP will dilute your ownership before the investment, you also increase the additional ESOP allocation by 10%. So, the dilution is not 3.33% but 3.67%. All shareholders experience a dilution of 3.67%. You can see that the original ESOP is now 9.6%. I added a line for the second ESOP pool, which is 3.7% of the additional allocation. If you look at the total ESOP line, you can see that the total ESOP before funding is 13.3%.

As a result, you have 41% ownership. Your initial marketer who had 10% now has 4.6% but in a more valuable company. Your seed investor now has 5.1%. The series A holders, who originally had 20%, now have 14.5%. The series B holders have not been diluted yet, so they still have 25%. Finally, overall, the ESOP accounts for 10% of your startup.

Why Do Companies Go for ESOP?

There are several reasons why companies use ESOP, such as it being a powerful tool to attract, motivate, and retain talented employees. With this program, ESOP can enhance employee loyalty, job satisfaction, and overall productivity due to enticing incentives.

Furthermore, ESOP offers employees the opportunity to build wealth over time through the growth of the company’s value and the increasing value of employee-owned shares. This can provide financial security and a sense of ownership for employees.

In addition, ESOP also fosters a culture of ownership and shared responsibility. This means that employees who have direct ownership in the company’s success tend to be more engaged, innovative, and committed to achieving organizational goals.

How are ESOPs Paid Out ?

Each company may have different rules for ESOP payments, but there are several common ways companies pay ESOP (Employee Stock Ownership Plan) to employees:

- Vesting Schedule

One of the most commonly used methods of ESOP payment is through vesting, which is based on a predetermined period during which employees gradually acquire rights to the allocated shares. For example, a vesting schedule may specify that an employee becomes fully vested (owns the shares entirely) over a three-year period, with a certain percentage of shares vesting each year. Once fully vested, the employee has complete ownership of the shares.

- Distribution upon Retirement

ESOP can provide stock distribution to employees when they retire, resign, or cease employment with the company. The specific rules regarding this distribution are usually outlined in each company’s ESOP plan.

- Sale or Acquisition of the Company

If the company is sold or acquired, ESOP can pay out shares to employees. Employees can either sell their shares as part of the sale transaction or receive payment based on the value of their shares at the time of the sale or acquisition.

Stages of a Company in Granting ESOP to Employees

The process of granting ESOP (Employee Stock Ownership Plan) to employees involves several important steps. Here is the sequence of steps commonly followed in this process:

- ESOP Policy Establishment

The company founders need to develop a detailed ESOP policy. This includes determining the percentage of shares to be allocated for ESOP, employee eligibility criteria, vesting schedule, exercise price determination method, and other relevant aspects of the ESOP program.

- Stock Valuation

To determine the number of shares to be allocated to employees, the company needs to conduct a valuation of its stock. This valuation can involve methods such as market approach, asset approach, or income approach performed by competent professionals.

- ESOP Agreement Creation

Once the stock value is determined, the company must draft an ESOP agreement that governs the rights and obligations of employees and the company regarding ESOP. This agreement includes details such as exercise price, vesting schedule, exercise period, special provisions, and other relevant matters.

- Granting ESOP to Employees

After the ESOP agreement is created, the company can start granting ESOP to eligible employees. This may involve the process of offering ESOP to employees who meet the eligibility criteria established in the ESOP policy.

- Vesting Implementation

Once employees receive ESOP, the vesting period begins. During this period, employees must fulfill the vesting requirements specified in the ESOP agreement, such as staying with the company for a certain period of time or achieving performance goals.

- ESOP Exercise

After reaching the vesting period, employees have the right to exercise their ESOP within the specified exercise period. At this point, employees can use their ESOP to purchase company shares at the predetermined exercise price.

- ESOP Administration Management

The company needs to have a good administration system to monitor and manage the ESOP program. This involves maintaining accurate records of share allocation, employee status changes, vesting schedules, and exercise implementations.

- Employee Communication

It is important for the company to provide clear information and communication to employees about the ESOP program. Employees need to understand their rights and obligations related to ESOP, the benefits they receive, and the tax consequences that may be associated with ESOP exercise and share sales.

By following these steps systematically, the company can ensure an organized and effective granting of ESOP to employees.

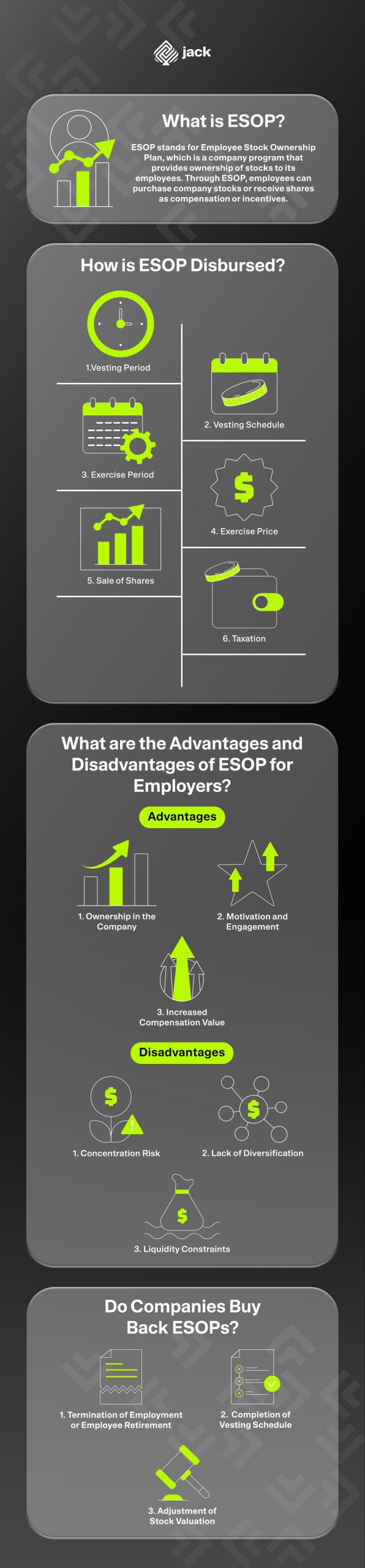

How is ESOP Disbursed?

Every company may have different rules for distributing ESOP (Employee Stock Ownership Plan) payments. However, there are several common stages that companies typically follow when disbursing ESOP to employees, including:

- Vesting Period

ESOP usually has a vesting period, which is a specific period of time that employees must go through before they can fully own their rights to the ESOP. The vesting period can last for several years with a predetermined vesting schedule.

- Vesting Schedule

Companies typically have a vesting schedule that determines the percentage of ESOP to be granted to employees at each point in time during the vesting period. For example, if the ESOP has a four-year vesting period with an annual vesting schedule, employees will receive a portion of their ESOP each year.

- Exercise Period

After reaching the vesting period, employees have a designated period of time to exercise their ESOP. This period is also known as the exercise period. Employees must take action to purchase shares using their ESOP before the exercise period ends.

- Exercise Price

The exercise price is the predetermined price set at the time of granting the ESOP and is used by employees to purchase shares. Employees will pay the exercise price to acquire the shares associated with the ESOP.

- Sale of Shares

After employees exercise their ESOP and acquire shares, they have the option to sell those shares in the market. The sale of shares can be done according to company policies or applicable rules. Employees can profit from the difference between the purchase price (exercise price) and the selling price of the shares.

- Taxation

At the time of ESOP disbursement, employees may be subject to taxes on the gains obtained from the sale of shares or when the shares are granted. The taxation can vary depending on the jurisdiction and applicable tax regulations.

How to Calculate ESOP for Employees?

There are several commonly used methods to calculate the value of Employee Stock Option Plans (ESOPs). Two frequently used methods are the Intrinsic Value method and the Black-Scholes method.

- Intrinsic Value Method

The calculation of ESOP value using this method is based on the difference between the stock price at the time the employee receives the stock (grant price) and the current market price. If the current market price is higher than the grant price, the ESOP value is the difference between the two prices multiplied by the number of shares held by the employee.

Example:

An employee named Ani receives 1,000 shares with a grant price of $10 per share. Currently, the market price of the company’s stock is $15 per share. Using the Intrinsic Value method, the ESOP value obtained by the employee would be ($15 – $10) x 1,000 = $5,000.

This method is relatively straightforward and easy to understand as it involves only the calculation of the stock price difference.

- Black-Scholes Method

This method is more complex and involves multiple variables such as stock price, vesting period, market volatility, risk-free interest rate, and expected dividends. The Black-Scholes method is commonly used to value stock options.

Example:

Ani is granted stock options to purchase 1,000 shares at an exercise price of $10 per share. The vesting period for the stock options is 4 years, the market volatility of the company’s stock is 30%, the risk-free interest rate is 5%, and there are no expected dividends.

Here are the steps to calculate the ESOP value obtained by Ani:

- Calculate the d1 factor using the following formula:

d1 = (ln(S/X) + (r + (σ^2/2)) * T) / (σ * sqrt(T))

Where:

– S is the current market price of the stock

– X is the exercise price

– r is the risk-free interest rate

– σ is the market volatility

– T is the vesting period in years

For example, if the current market price (S) is $15:

d1 = (ln(15/10) + (0.05 + (0.3^2/2)) * 4) / (0.3 * sqrt(4))

d1 = (ln(1.5) + (0.05 + 0.045) * 4) / (0.3 * 2)

d1 = (0.4055 + 0.18) / 0.6

d1 = 0.9758

- Calculate the d2 factor using the following formula:

d2 = d1 – (σ * sqrt(T))

If d1 = 0.9758, then:

d2 = 0.9758 – (0.3 * sqrt(4))

d2 = 0.9758 – (0.3 * 2)

d2 = 0.9758 – 0.6

d2 = 0.3758

- Calculate the ESOP value:

Option value (V) = S * N(d1) – X * exp(-rT) * N(d2)

Where:

– N(d1) is the cumulative value from the standard normal distribution with input d1

– N(d2) is the cumulative value from the standard normal distribution with input d2

– exp(-rT) is the discount factor to calculate the present value

If S = $15, X = $10, r = 0.05, and T = 4, then:

V = 15 * N(0.9758) – 10 * exp(-0.05 * 4) * N(0.3758)

Using the previously calculated values, you can replace N(d1) and N(d2) with the corresponding values from a standard distribution table or use statistical software or calculators to compute them. After that, substitute these values into the formula above to obtain the ESOP value.

This method is more complex and requires an understanding of mathematical and financial concepts. Typically, companies use mathematical models or specialized software to calculate the value of ESOPs based on the Black-Scholes method.

What Happens to ESOP if you Quit?

When an employee resigns or leaves a company, the treatment of their ESOP shares depends on the provisions outlined in the ESOP plan and applicable agreements.

If the employee’s ESOP shares are fully vested, meaning the employee has completed the vesting period or other vested requirements, they have the right to retain the vested shares.

However, if the employee has unvested ESOP shares at the time of resignation, they may lose the rights to those shares. Unvested shares are typically subject to a vesting schedule, so if the employee does not meet the vested requirements before leaving the company, they may forfeit their rights to the unvested shares.

As for the company’s policy regarding ESOP shares of resigning employees, they may have the option to repurchase the employee’s shares. This allows the company to buy back the shares and distribute them to other employees or retain ownership within the company.

What are the Advantages and Disadvantages of ESOP for Employers?

Understanding the benefits and drawbacks is useful for companies to evaluate the overall financial situation and risks before making decisions regarding ESOP participation.

Here are the advantages of ESOP for employers:

- Ownership in the Company

ESOP provides employees with an opportunity to own shares in the company they work for. This makes qualifying employees automatic owners of the company, entitling them to dividends and a share in the company’s value growth.

- Motivation and Engagement

Another benefit of ESOP for employees is increased motivation and a greater sense of involvement in achieving the company’s goals. Employees recognize that the company’s success also benefits them personally.

- Increased Compensation Value

ESOP shares can be part of an employee’s compensation package, enhancing the total value of compensation received from the company. If the stock price rises, the value of the employee’s stock ownership also increases.

On the other hand, here are some disadvantages of ESOP for employees:

- Concentration Risk

Employees with ESOP shares face concentrated risk because a significant portion of their ownership is tied to the performance of the company’s stock. If the stock value declines, it can have a negative impact on the value of their stock ownership, especially if they are heavily invested in the company’s stock.

- Lack of Diversification

Related to the previous point, employees with ESOP shares may have limited investment diversification since a significant portion of their assets is tied to the company’s stock. This poses a disadvantage as it can increase personal financial risk if the company encounters difficulties or fails.

- Liquidity Constraints

Lastly, ESOP shares also have limited liquidity, meaning they are not easily tradable or exchanged for cash. Employees may face obstacles in accessing the value of their shares until specific events occur, such as retirement, leaving the company, or a company sale.

Do ESOPs have Expiry?

ESOP generally has a specific duration or expiration date outlined in the respective company’s plan documents.

The duration of ESOP can vary depending on the company’s objectives and specific provisions of the plan. Some ESOPs may have a fixed duration, such as 10 years, while others may have an ongoing structure without a predetermined expiration date.

When ESOP reaches its expiration date, several options can occur, such as the company deciding to terminate the ESOP and distribute shares to participants, converting the ESOP into another form of ownership plan, or renewing the ESOP for an additional period.

What is the Minimum Period for ESOP?

There is no specific minimum period required for ESOP as it varies depending on the company’s policies and the provisions stated in the ESOP plan documents.

Some companies may choose to implement ESOP with a minimum period, such as one year, while others may have a longer minimum period, such as three or five years. The minimum period is typically defined as the length of time an employee must spend with the company before their ESOP shares become vested or fully claimable.

For those who are not familiar with the term “vested,” it refers to the process by which an employee acquires rights to ESOP shares over time. The vested schedule is determined by the company and can vary in terms of the length of service required for full vesting.

Who is the Good Candidate for an ESOP?

The best candidates to receive ESOP are employees who are deemed to have made significant contributions to the growth and success of the company.

Additionally, employees who demonstrate long-term commitment to the company, including those who have been with the company for several years and have a consistent track record of contributing to the company’s success, can be suitable candidates for ESOP.

Who Controls an ESOP?

ESOP is typically managed and controlled by a trustee, an individual or legal entity appointed to manage assets or interests on behalf of others.

The primary role of the trustee is to act in the best interests of the ESOP participants, the employees. They have a fiduciary responsibility, which means they must carry out their duties carefully, faithfully, and prudently, placing the interests of the participants above their own personal interests.

In addition, the trustee is responsible for acquiring and holding company stock on behalf of the ESOP, distributing shares to eligible participants, managing the voting rights associated with the shares, and ensuring that the ESOP operates in accordance with the plan documents and legal requirements.

While the trustee has control over the administration and management of ESOP, the company that sponsors the ESOP retains control over its operations and business decisions. The company’s management team, board of directors, and senior executives continue to run the day-to-day operations of the company.

Do Companies Buy Back ESOPs?

Yes, the company has the option to buy back ESOP shares from employees in certain situations and according to the provisions outlined in the ESOP plan documents.

There are several common situations in which the company may choose to buy back ESOP shares, such as:

- Termination of Employment or Employee Retirement

When an employee leaves the company, whether due to retirement, resignation, or termination of employment, the company has the right to buy back the employee’s ESOP shares. This process is usually governed by the buyback provisions in the ESOP plan.

- Completion of Vesting Schedule

ESOP shares are typically subject to a vesting schedule, which determines the length of service required for employees to become fully vested in their shares. Once the employee’s shares have become vested, the company may have the option to buy back those shares from the employee.

- Adjustment of Stock Valuation

ESOP usually specifies the valuation of shares based on an independent appraisal. If there is a significant change in the company’s valuation, such as a significant increase or decrease in the stock price, the company may have the right to buy back the shares at a predetermined price or based on a formula specified in the ESOP plan.

See also video tutorials from financial and business from Jack.

Use Jack for your business needs

The specifics and procedures for the buyback of ESOP shares will vary depending on the company’s ESOP plan and the provisions outlined in the plan documents. It is advisable for the company to consult legal and financial advisors to ensure compliance with applicable laws and establish a clear process for the buyback of ESOP shares.