Startup corporate cards have a very significant role in carrying out financial management. Running a business, of course, requires highly qualified financial management and the employee concerned will be given responsibility for making purchases related to business needs in order to obtain support, including safer and more transparent payment instruments.

A corporate card is a type of credit card issued to company employees that can be used to pay for work-related expenses without having to submit a reimbursement request.

However, this corporate card can also be in the form of a credit card or prepaid card according to the request of its users.

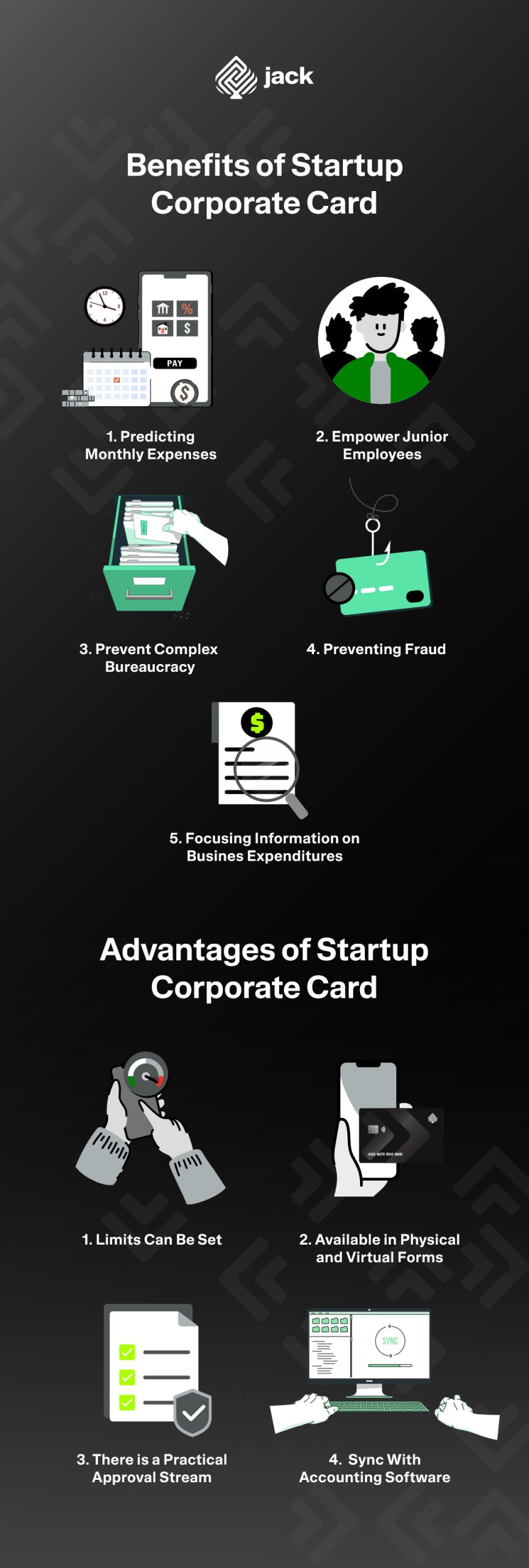

Benefits of Startup Corporate Card

This startup corporate card can help startup companies to ensure that the funds provided are more accessible to the right people, at the right time and for the right reasons.

In using this corporate card, an expense management platform has been provided which can later help to streamline more complex administrative processes.

As for the details of the benefits of the startup corporate card as follows:

1. Predicting Monthly Expenses

In its own use for corporate card limits can be made arrangements directly by the management. That way it will be easier to make predictions for expenses made every month from each card according to the amount of money that has been put on the card.

2. Empower Junior Employees

In well-established corporations, of course, only high-level employees can obtain the corporate card. For startups, of course, this corporate card can be given to junior employees so they feel empowered and trusted by the company.

If later at any time require costs for work purposes. Of course, the employee concerned only needs to use the card without having to submit a reimbursement.

3. Prevent Complex Bureaucracy

The existence of a complex and multi-layered bureaucracy is generally not in accordance with the culture of the startup itself.

Startup corporate cards will certainly support financial matters, bookkeeping and taxation can be done in an easier and more practical way without having to wait for a signature from the boss.

This certainly allows for a more practical way to prevent complex bureaucracy because you have to wait for your boss to get a signature if it turns out that the boss has a business trip which makes it difficult to use the card.

The use of this corporate card allows approval to be given online through the application that has been used.

4. Preventing Fraud

The dashboard that has been provided for this startup corporate card application, of course, has several options for tracking every expenditure including all proof of payments made.

That way management can watch every expenditure from one card to another to ensure there is no fraud in the transactions made.

Moreover, this card will be used by company employees, of course, it must be carefully considered so as not to cause fraud. As is the case for inflating costs for purchases during the reimbursement process.

5. Focusing Information on Business Expenditures

The startup corporate card has the benefit of centralizing all information on business expenses. Most of the corporate cards are indeed equipped with an application that has a dashboard to be able to access all the desired features.

With this dashboard, of course, all information for business expenses can be collected and accessed in an easier and more practical way. This of course will be beneficial for every employee and management in concentrating all the information to become one.

Benefits of Startup Corporate Card and Its Advantages in Infographics

Advantages of Startup Corporate Card

1. Limits can be set

In the management system, you can indeed tamper with corporate card limit rules that can be adjusted to your needs. Like this month, one employee wants to get a limit of 5 million because there are items that must be paid later.

However, for the following month the limit was lowered to 2 million because there was no task that needed to be done in making a special purchase. The limit applied to this corporate startup card can be increased or decreased in the same month according to the spending needs.

2. Available in Physical and Virtual Forms

The startup corporate card, which is very suitable for use by startup companies, comes in a physical form that is very similar to a regular payment card. However, this corporate card is in virtual form.

See also video tutorials from financial and business from Jack.

So if employees need to make payments for business needs that are made online, of course, they don’t need to be confused anymore to bring a physical card. The use of this virtual card can be used to pay for business transaction activities that are easier and more practical.

3. There is a Practical Approval Stream

The flow for approval in purchasing business needs can be made more concise. Thus for every employee or employee of course no longer need too long to wait for confirmation given by the company’s superiors.

Of course, the supervisor concerned does not have to sign several files to give approval for the use of the corporate card. All activities carried out can be carried out through an application that is connected to the use of the card.

4. Sync With Accounting Software

This corporate card startup already has a very complete service and of course it can be synchronized using the accounting software provided by the company concerned.

Use Jack for your business needs

See also video tutorials from financial and business from Jack.

That way, for every transaction activity carried out, it can be immediately recorded in order to carry out the processing in the software for the benefit of financial bookkeeping, which includes tracking and reporting money from companies that leave.