Financial startups have become a popular sector pursued by Indonesian entrepreneurs, particularly in financial technology.

Startups in this sector in Indonesia have provided opportunities for people from various regions and backgrounds to engage in easier transaction activities, supported by sophisticated digital systems that are easily accessible from anywhere as long as they are connected to the internet.

See Also: Corporate Credit Card: Definition, Types, Benefits, and How Cards Work for Startups

There are already well-known financial startups in Indonesia

Although Indonesia may not have widespread familiarity with the concept of banks, the players in the financial technology business in Indonesia have proven their achievements and contributions internationally.

Doku

Doku is one of the most senior financial technology startups in Indonesia, starting its operations in 2007. It offers services to both consumers and businesses.

Upon visiting the main page of their website, you can explore the four service products provided for businesses. Medium-sized e-commerce entrepreneurs and large-scale businesses can utilize Doku’s products to facilitate payment collection and processing.

For consumers, financial technology in Indonesia is closely associated with the color red, symbolizing services that simplify online transactions.

If you enjoy online shopping, Doku can assist you in managing your transactions and monitoring your expenses. You can easily separate your shopping expenses and savings, which can be stored in fixed deposits or savings accounts.

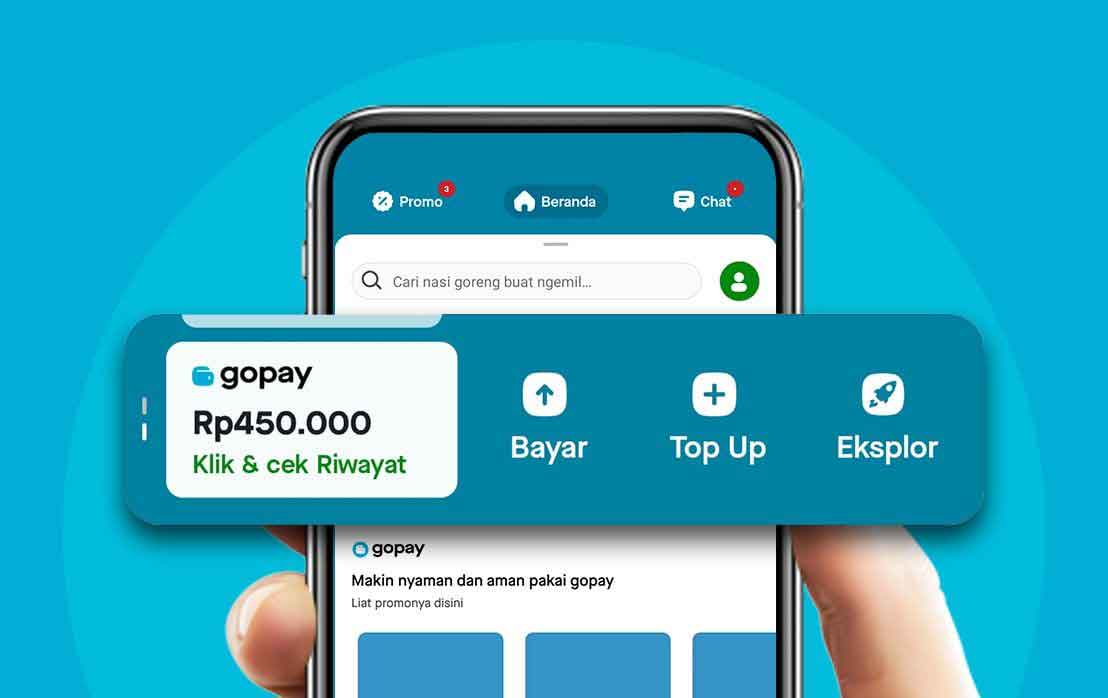

Gopay

Gopay is a product offered by a financial startup in Indonesia and has gained popularity due to the increasing mobility of urban residents. This transportation-focused startup contributes to the growth and convenience of financial technology in Indonesia.

Initially known as Gojek Credit, Gopareimy was originally designed for in-ride transactions. Eventually, Gopay acquired PonselPay to expand its operational capabilities.

Gopay is not only used by the younger generation but also by people of different age groups, including parents and teenagers. It can be used for various payments, such as food purchases and prepaid mobile credit, providing convenience through advanced technology for the wider community.

Amartha

One of the financial startups in Indonesia is Amartha, which is part of the Indonesian financial technology industry that has ventured into the peer-to-peer lending sector. Amartha provides loans starting from 3 million for micro and small traders to start their businesses.

These traders are connected with individuals who can make small investments, and the loan and investment system has a social impact that was previously unimaginable.

In addition to providing new opportunities for investment and capital needs, it also creates more job opportunities.

This Indonesian financial technology startup is highly creative in customizing approaches to meet the needs of potential consumers.

See Also: Easier, Automatic, and Real-Time Transactions with API Disbursement

Bareksa.com

The Indonesian financial startup industry also offers services and products related to mutual funds, similar to what banks offer. Bareksa.com is a financial technology startup in Indonesia that provides a wide range of mutual fund products with comprehensive data.

The platform offers various features that provide more information about mutual funds, the importance of investing for the future, and investment managers organized according to the needs of each user.

Bareksa.com can be considered a marketplace that offers comprehensive packages to support investment information, businesses, and the latest information on stocks and bonds that can be checked directly.

The good news is that this financial startup in Indonesia has obtained official permission from the OJK (Financial Services Authority) to act as a sales agent for mutual fund securities, supported by its advanced innovations.

Jojonomic

If you are tired of handling office reimbursements and daily expenses, you can use Jojonomic one of the financial technology startups in Indonesia to manage your personal finances.

To support individual users, the application is still affordable, as it is free. However, if you want to use it with a team in your office, the cost is around 54,000 IDR, and it offers various product options for businesses and larger enterprises.

This startup continuously provides interesting ideas to attract new users and keep existing users engaged, even with many existing financial technology competitors in Indonesia that help manage personal finances.

Jojopoints are special rewards and incentives designed to encourage users to continue using the application, which has been available on Android and iOS devices since 2015.

See also video tutorials from financial and business from Jack.

Use Jack for your business needs

These are some of the successful financial startups available in Indonesia. The latest innovations in financial technology provide opportunities for easier and more practical transaction activities.

That’s the information about some financial startups in Indonesia. We hope this information is beneficial to all readers.