The trend of credit card payments is increasingly changing how we transact today. Using credit cards has indeed become an integral part of modern financial life.

See Also Corporate Credit Card: Definition, Types, Benefits, and How Cards Work for Startups

With various features and conveniences offered, credit cards are not just a means of payment. They also serve as financial instruments that change how we manage finances.

Here are some major trends in credit card payments to be aware of. But first, let’s understand the benefits of using credit cards.

Benefits of Credit Cards

1. Ease and Convenience

Credit cards make transactions easy both online and offline. Consumers no longer need to carry large amounts of cash. Additionally, transactions can be made at various places that accept credit cards, including abroad. Thus, it’s no surprise that the trend of credit card payments is on the rise.

2. Security

Credit cards provide an additional layer of security. If the card is lost or stolen, the cardholder is usually protected from unauthorized transactions. Technologies like EMV chips and tokenization help secure user data.

3. Rewards and Cashback Programs

Many credit cards offer loyalty programs such as reward points that can be exchanged for gifts or cashback on certain purchases. These incentives make credit card usage more beneficial, driving the trend in credit card payments in society.

4. Building Credit History

Good credit card usage helps build a positive credit history. A good credit history is important for obtaining loans or credit in the future with lower interest rates and better terms.

5. Travel Insurance and Additional Benefits

Some premium credit cards offer free travel insurance, including coverage for flight delays, lost luggage, and accidents. These additional benefits can save costs and provide peace of mind while traveling.

6. Better Financial Management

Credit cards often provide monthly statements detailing all transactions, helping users track spending and manage their budget more effectively.

7. Promotions and Discounts

Banks and credit card issuers often collaborate with merchants to offer exclusive discounts and special promotions for credit cardholders. These promotions can include discounts at restaurants, retail stores, hotels, and other entertainment venues.

Trends in Credit Card Payments

1. Growth of Digital Payments

One of the most notable trends in credit card payments is the increasing use of digital payments. Integration of credit cards with digital wallets has made transactions easier and faster, such as Apple Pay, Google Wallet, or Samsung Pay. Consumers can make payments simply by directing their phones at payment terminals without swiping or inserting a physical card.

2. Enhanced Security

Security is a top priority in credit card payments. EMV chip technology has become the global standard, replacing traditional magnetic strips that are more vulnerable to data theft. Additionally, two-factor authentication and tokenization are used to enhance fraud protection, where sensitive data is replaced by a unique token during transactions.

3. Contactless Payments

Contactless payments are also a popular trend, especially during the COVID-19 pandemic that drove the adoption of touchless transactions. Credit cards equipped with Near Field Communication (NFC) technology allow users to make payments by simply tapping the card on the payment terminal, reducing the need to touch any devices.

4. Loyalty Programs and Cashback

Loyalty programs and cashback are major attractions for credit card users. Banks and credit card providers offer various incentives, from reward points redeemable for various gifts to cashback on certain purchases, encouraging credit card use and increasing customer loyalty.

5. Easier International Payments

Credit cards facilitate international payments for travel and online shopping on international sites. Many credit cards now offer competitive currency conversion rates and lower foreign transaction fees, making credit card payments a convenient choice for cross-border transactions.

6. Virtual Credit Cards

Virtual credit cards are a recent innovation that offers an additional layer of security for online purchases. These cards do not have a physical form but a virtual card number that can be used for one-time transactions or over a specific period, reducing the risk of card information theft.

7. Blockchain Technology

Blockchain technology is being used to enhance security and efficiency in credit card payments. Blockchain can ensure that transactions are recorded securely and transparently, reducing the risk of fraud and transaction errors.

8. Personal Financial Management (PFM) Tools

Some credit card providers now offer integrated personal financial management tools with user accounts. These features help users track spending, set budgets, and gain insights into their spending habits.

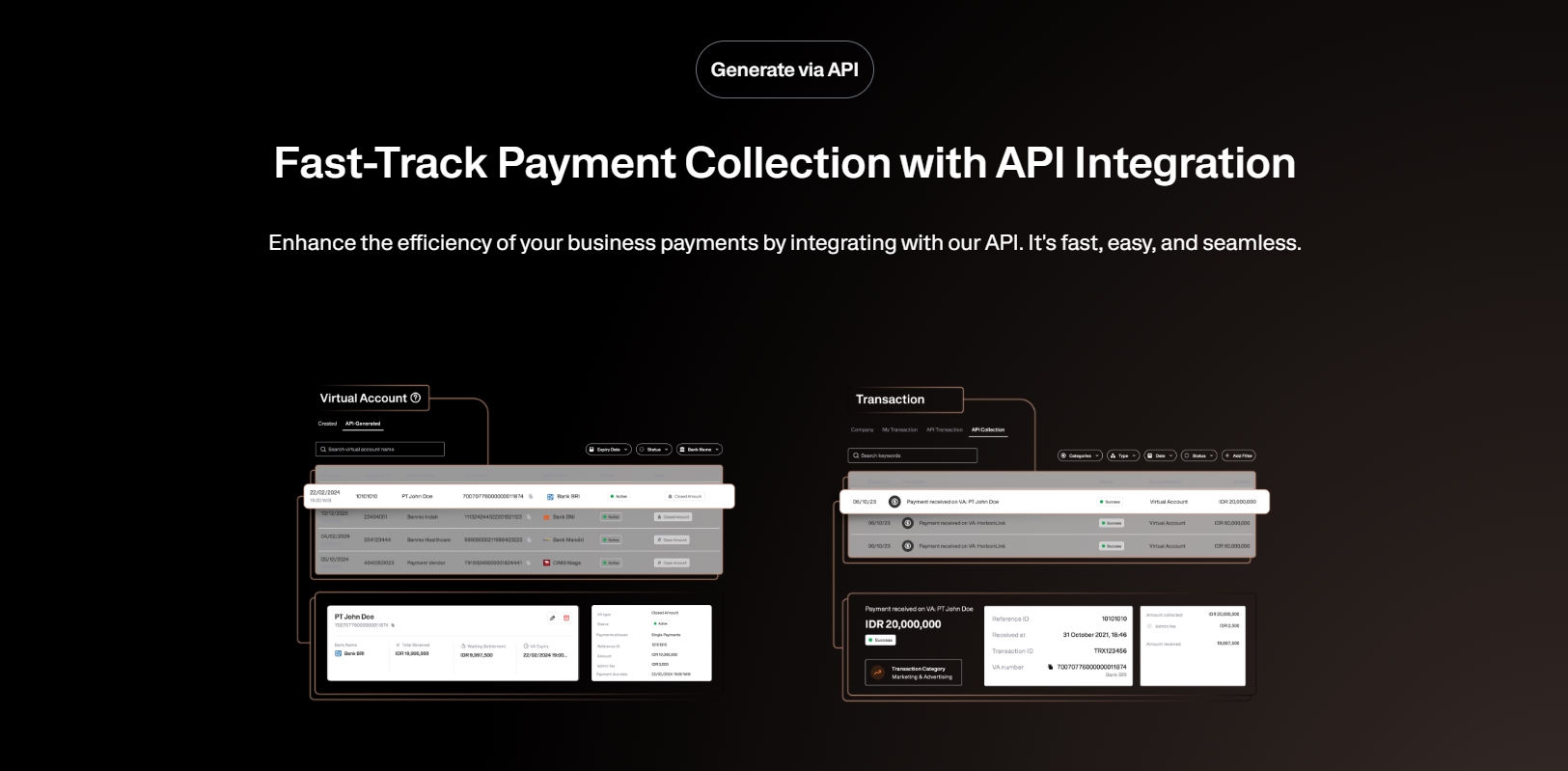

See the API Document from Jack Finance here

9. Advances in AI and Big Data

The use of artificial intelligence (AI) and big data analytics allows credit card providers to offer more personalized offers. By analyzing spending patterns and user behavior, companies can enhance the overall user experience.

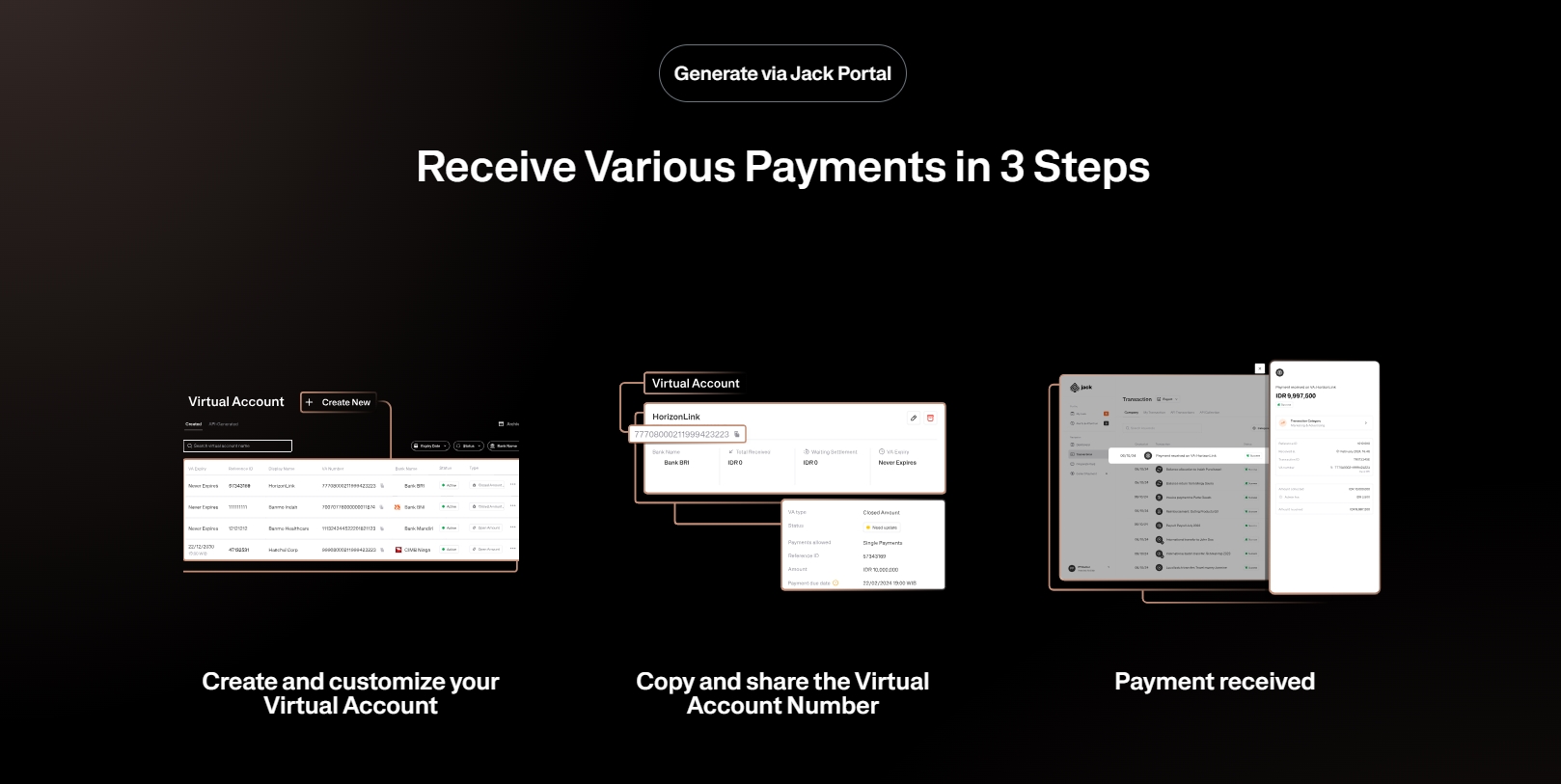

Use Jack for your business needs

The trends in credit card payments continue to evolve with technological advancements and changes in consumer behavior. Enhanced security and ease of digital payments make credit cards increasingly relied upon by many consumers. Moreover, various innovations make credit cards a safer and more efficient payment tool.