The differences between taxes and fees are quite pronounced when examined in detail. Both taxes and fees are forms of mandatory charges imposed by the government to generate revenue. They must be paid by the public in accordance with the prevailing regulations.

See Also Corporate Credit Card: Definition, Types, Benefits, and How Cards Work for Startups

Despite their similarities, taxes and fees have significant differences, especially in terms of their purposes. They also differ in their usage and characteristics.

Definition Differences Between Taxes and Fees

Definition of Taxes

Taxes are mandatory payments made by taxpayers to the government. Taxpayers can be individuals or entities such as companies. This payment is not accompanied by a direct or specific compensation to the individual or business entity paying it.

Taxes are essentially contributions from the public to the state, often seen as mandatory contributions. Taxes, which can seem coercive, are closely related to income, whether individual or corporate, as well as the purchase price of goods and ownership of goods.

Generally, taxes are used to finance various government expenditures such as infrastructure, education, and healthcare services.

Definition of Fees

Fees are payments made by individuals or businesses to local governments to obtain specific services or benefits. Fees are usually associated with the use of certain public infrastructure or facilities, such as toll roads, parking, or business permits.

Fees, which are considered local charges, are paid for the acquisition of services or government-owned businesses, whether the services are received directly or indirectly. These services are provided by local governments to meet the interests and needs of individuals or entities.

Purpose Differences Between Taxes and Fees

Purpose of Taxes

The primary purpose of taxes is to increase government revenue, which is then used to finance public services and programs needed by the community. Taxes support the economic function of the state and ultimately enhance economic productivity. Tax revenue is used to cover various budgetary expenses, making the purpose of taxes distinct from that of fees.

Purpose of Fees

The purpose of fees is to finance or cover the costs of production, maintenance, or development of infrastructure. In other words, fees are established to fund specific services used by individuals or entities.

Those utilizing certain facilities can pay the associated fees, helping the government finance public needs. Fees facilitate smooth economic activities within a region and are expected to reduce social disparities by controlling market prices and creating new job opportunities.

Characteristic Differences Between Taxes and Fees

Characteristics of Taxes

Taxes, being mandatory charges on the public, are general in nature and indirectly related to the use of certain services or facilities. Taxes are broadly applied across various populations and economic sectors, differing from fees, which are more specific. Fees are directly linked to the use of particular services or facilities and are typically applied to individuals or businesses directly accessing these infrastructures or services.

Characteristics of Fees

Fees are implemented by local governments based on Government Regulations and Local Regulations. In contrast, taxes are imposed on the public according to Law Number 6 of 1983, which governs taxation procedures to ensure fair and proper implementation.

Rate Determination for Taxes and Fees

Tax Rate Determination

Tax rates are usually determined based on various factors, such as individual or business income. For example, income tax (PPh) is only imposed on individuals aged 18 and over, with the amount depending on their annual income. The higher the income, the higher the PPh to be paid.

See the API Document from Jack Finance here

Fee Rate Determination

Fee rates are generally based on the actual or estimated costs associated with providing specific services or facilities, including operational, maintenance, or investment costs. A common example of a fee is parking fees on public roads.

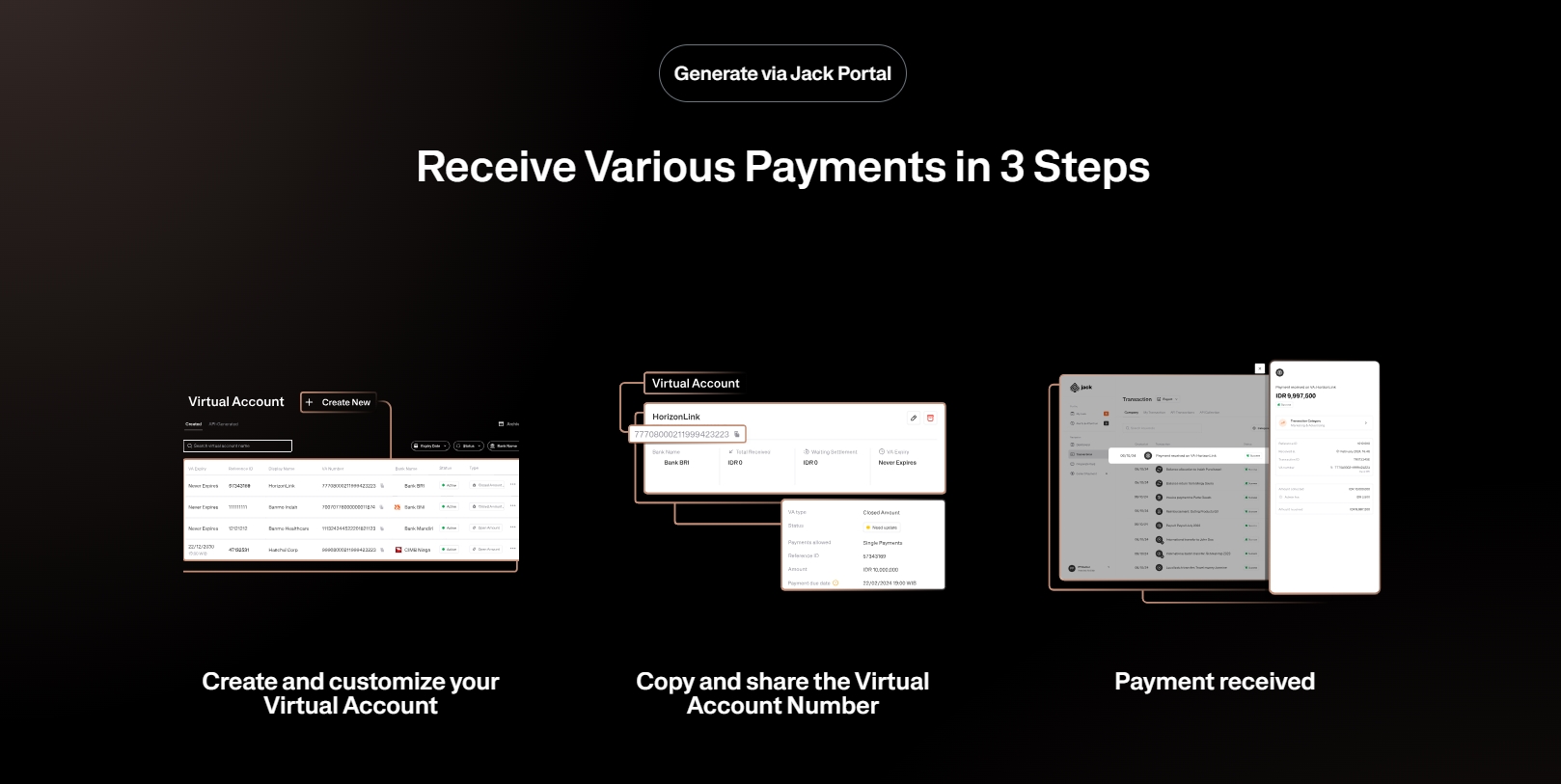

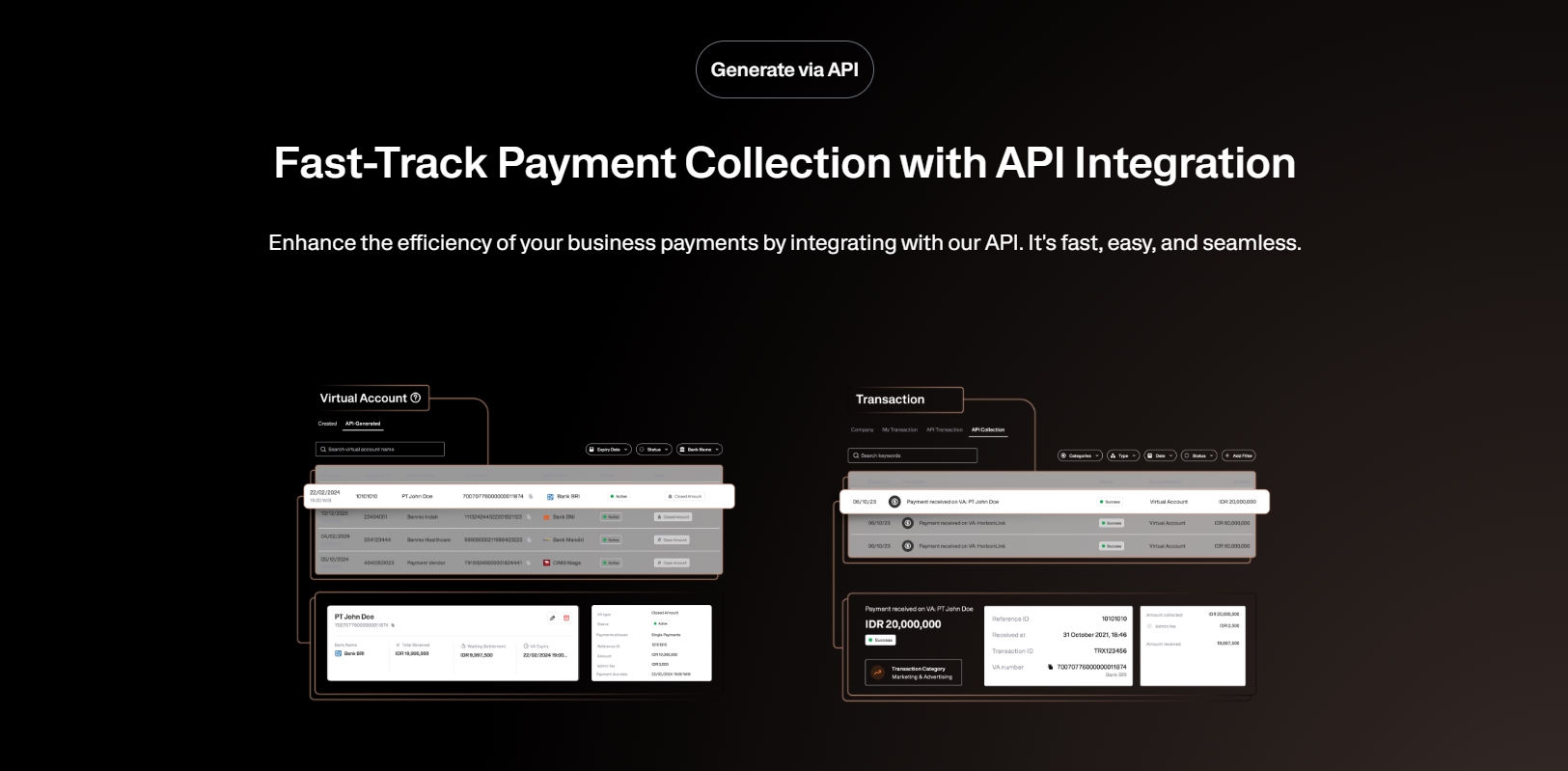

Use Jack for your business needs

Understanding the differences between taxes and fees clarifies how these charges contribute to public finances. This knowledge also highlights the development of infrastructure and necessary services. Governments use both instruments to ensure sufficient revenue to meet public needs and finance essential public services.